Share this

Concentrate on Dividend Level and Dividend Growth

by Kevin Malone on Jul 18, 2023

Stock Market Future Returns?

Concentrate on Dividend Level and Dividend Growth

The S&P 500 started in 1958 and the return since then the annualized return has been 10% with 3% coming from dividends, but neither the 10% nor the 3% have been linear. From 1958-1968 the total return of the S&P 500 was 13%, from 1969-1981 it was 5%, from 1982-1999 it was 18% and from 2000-2018 it was 5%. We looked at dividend yield going back farther than 1958, and the average dividend yield at the start of a decade going back to 1871 was 4.8% and from 1961 was 3.2%. The low dividend yield of the last 19 years is the anomalous period. While there are many great companies that pay a reasonable dividend and raise their dividends consistently, tech stocks and the FAANG stocks as a group do not focus on dividends. Unfortunately, this is what investors have been focused on, and this is why dividends are as low as they are today.

Jeremy Siegel reconfigured the S&P 500 rather than by capitalization by contributions to the dividends of the index. He found doing so created 22% excess return, 12.6% vs. 10.3%. This is the only study we have see of a complete reconfiguration of an index, but we have seen many other studies showing that getting higher dividend yields results in higher total returns. Our High and Growing Dividend Portfolio has returned 7.6% over the last 19 years when the S&P 500 returned 4.9%.

Enormous amounts of time and energy are put into attempting to determine future returns from stocks. The formula to determine the returns of the S&P 500 ten years from now is simple: you take the current index level and multiply it by earnings growth over the next decade, adjust that for the difference between the current and final PE, and then add the current yield adjusted for dividend growth. Easy, right? Well, let's examine what we know for certain, what we need to make judgments of and how hard those judgments might be. We know for certain the current level of the index, the current PE and the current dividend yield. What we do not know are earnings growth over the next decade, the final PE ten years from now and dividend growth. Now we would argue that all three of those, earnings growth, future PE and dividend growth are difficult to predict. Analyst have huge margins of error attempting to predict the earnings growth of any stock 90 days from now, so earnings growth over 40 quarters they would say would be nearly an impossible task. The future PE is also wrought with too many variables to expect success. While we also think dividend growth is difficult, it is clearly the easiest of the three. We can look at historical dividend growth, dividend payouts and make a judgment that would have the lowest margin of error of the three.

What Will Ten Years from Now Look Like?

What we know is that the PE of the S&P 500 is higher than the average PE historically and the dividend yield at 2.2% is lower than the average dividend yield. Together these would suggest ten years from now we will have lower returns than the long‐term average of the index. Now the question of how much lower is an open question, and it should be noted the returns could be higher than average. There are any number of ways analysts use to attempt to predict the future return. Bob Schiller averages the earnings of the last 10 years and then compares that PE with long‐term history. He predicts the next 10‐year return will be 2% annualized. Jeremy Siegel uses the current PE level to make his projection, and he predicts 5% annualized. When we look at large companies who do this work like Blackrock or Goldman Sachs, we see most firms siding with Jeremy Siegel. We do not find any credible analysts who predict higher returns. So, we have used 5% for future returns in our planning and analysis of investment strategies.

High and Growing Dividend Portfolio

We use three managers in our High and Growing Dividend Portfolio. Dearborn Partners manages our domestic large cap portfolio and they had a 3.5% dividend yield on their portfolio at the end of 2018. Janus Henderson manages our international large cap portfolio, and they had a dividend yield of 4.6% at the end of 2018. North Star manages our domestic small cap portfolio, and they had a 5.3% dividend yield at the end of 2018. Clients vary in exactly how they allocate to these portfolios, but if you allocated 40% to Dearborn Partners, 40% to Janus Henderson and 20% to North Star, you would have a dividend yield on that portfolio of 4.3%. The analysis of Bob Schiller, Jeremy Siegel, Blackrock, Goldman Sachs and others would project much higher future returns if the S&P 500 had a 4.3% current dividend yield rather than a 2.2% dividend yield. We know this because the current dividend yield is an important factor in their work.

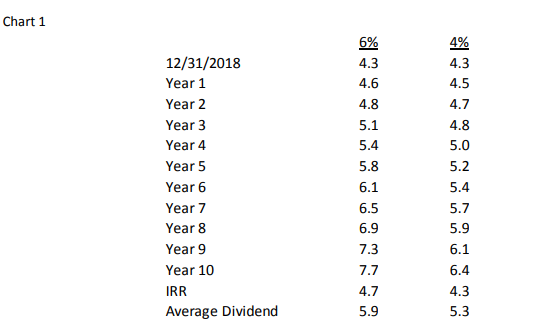

Our work in projecting future returns will always focus just on dividend level and dividend growth. We believe our margin of error in projecting future PE ratios or future earnings growth would be no better than the analysts whom we criticize for even attempting this. Since we know our current dividend level, our only variable is dividend growth. Now we said above this projection is a difficult one, but we have historical and projected data that we believe is reasonable. The S&P 500 dividend growth since 1958 has been 5.75% and over the last decade has been 8%. In addition, we have historical dividend growth data from our managers. Over the past 5 years, our 3 managers weights 40/40/20 as we stated above have dividend growth of 8%. The projected data comes from our managers, and they each believe over the next decade 8% is a reasonable number to use. But, we do not trust that estimate. It would be hypocritical of us to suggest dividend growth is a difficult projection, and then just use the projection given to us by our managers. We will certainly have many surprises over the next decade, and we believe our managers will maneuver these well; however, just taking their number would be to suggest they will maneuver what comes their way perfectly. So, we cut that number by 25% and 50% to see what that data would tell us. We grow dividends at 6% and 4% and use that data to test our thesis. Chart 1 shows the results of these tests.

Growing dividends at 6% will result in an Internal Rate of Return of 4.7%, an average dividend yield of 5.9% and a final dividend of 7.7% over the decade. The results at 4% dividend growth are an IRR of 4.3%, an average dividend yield of 5.3% and a final dividend yield of 6.4%. The average dividend yield of our High and Growing Portfolio would be over the 5% target of the analysts we surveyed, 5.9% if 6& dividend growth is right and 5.3% if 4% is right.

Should this surprise you?

On many levels the definitive answer is no. The work of Jeremy Siegel and our historical outperformance of the S&P 500 are proof of that.

What will returns be over the Next 10 Years?

We will leave that projection to other analysts. What we know is our strategy will result in high income and a final dividend yield that looks very attractive today. If dividends grow and just 4%, half of their history, the final dividend yield will be 6.4% and if they do better at 6% it will be 7.7%. Will that be the best investment solution over the next decade? Likely, the answer to that question is no, there may be another Tech bubble or FAANG stock type bubble that will achieve higher returns. But, it will be a good return.

Disclosure

Greenrock Research is a registered investment advisor.

The information provided herein is intended for financial professionals and represents the opinions of Greenrock Research Management, and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance is not necessarily indicative of future returns and the value of investments and the income derived from them can go down as well as up.

Our views expressed herein are subject to change and should not be construed as a recommendation or offer to buy or sell any security or invest in any sector and are not designed or intended as basis or determination for making any investment decision for any security or sector.

There is no guarantee that the objectives stated herein will be achieved.

All factual information contained herein is derived from sources which Greenrock believes are reliable, but Greenrock cannot guarantee complete accuracy.

Any charts, graphics or formulas contained in this piece are only for the purpose of illustration.

Unless otherwise indicated, S&P 500 historical price/earnings data herein is from www.standardandpoors.com, SP500EPSEST.xls. S&P 500 and S&P Top 100 by dividend yield historical return data provided by Siegel, Jeremy, Future for

Investors (2005), With Updates to 2017. S&P 500 total returns since 1970 are supplied by Standard & Poor’s. S&P 500 data prior to 1970 is Large Company Stock data series from Morningstar’s Ibbotson SBBI 2009 Classic Yearbook. Each stock in S&P 500 is ranked from highest to lowest by dividend yield on December 31st of every year and placed into “quintiles,” baskets of 100 stocks in each basket. The stocks in the quintiles are weighted by their market capitalization. The dividend yield is defined as each stock’s annual dividends per share divided by its stock price as of December 31st of that year.

References to “returns” refer to the total rates of return compounded annually for periods greater than one year, with dividends reinvested on the S&P as a whole, or on the Model, as applicable, for the period of time (years) indicated. As such, “returns” are a measure of gross market performance, not the performance of any client’s investment portfolio (which would ordinarily be subject to management fees and, possibly, custodian fees and other expenses). Index data is supplied by Morningstar Direct.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited.

Share this

- November 2025 (1)

- October 2025 (1)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- May 2024 (2)

- April 2024 (2)

- March 2024 (1)

- February 2024 (1)

- January 2024 (2)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (3)

- June 2023 (4)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

.png?width=2167&height=417&name=Greenrock-Logo%20(1).png)