Share this

How to Adjust a 60/40 Portfolio to Include Alternative Investments

by Kevin Malone on Jul 18, 2023

How to Adjust a 60/40 Portfolio to Include Alternative Investments

- The next 10 years will be about getting the return portion of risk allocation right.

- Traditional fixed income will only reduce volatility, but will not meet investors income or return needs.

- Combining stocks and bonds with liquid alternatives will deliver returns to the client that will meet their long-term investment needs at a level of volatility they can withstand.

The 60/40 portfolio was a favorite of clients because it represented the dot on the efficient frontier that offered the highest return commensurate with the lowest unit of risk. Increasing an equity allocation to the 60/40 portfolio did provide higher theoretical future returns, but did so by adding to the volatility of the portfolio. Conversely, increasing fixed income allocation to the 60/40 portfolio reduced volatility, but also reduced potential return.

Clients today face a difficult investment dilemma because interest rates are low. Future expected returns from fixed income almost certainly will not exceed the present low coupon levels from bonds and will be near zero to negative when interest rates begin to rise.

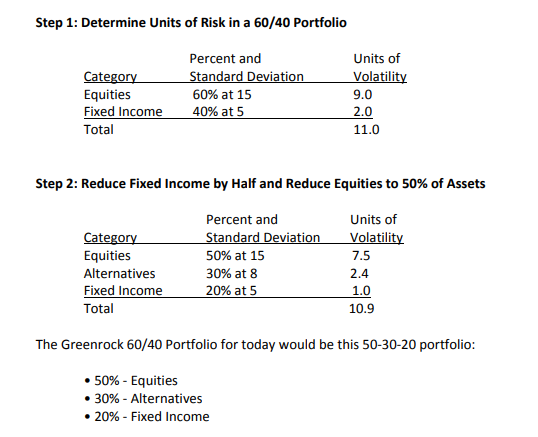

The solution to low or even potentially negative future fixed income returns, is to reduce the fixed income portion of the portfolio and add alternative investments. But, the expected volatility of alternatives is higher than the expected volatility of fixed income. So, if one just replaced the reduction of fixed income with alternatives, the new portfolio would have a higher volatility level than the existing portfolio. The only way to adjust the new portfolio so that the volatility is not increased is by simultaneously reducing both equities and fixed income and replacing them with alternative investments.

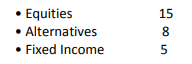

To consider the impact of such a reduction of both equities and fixed income with replacement by alternative investments, assumptions must be made about the future standard deviations of these three asset classes. For this analysis the following assumptions have been made:

In this analysis we use units of risk, this being standard deviation multiplied by the applicable allocation. Additionally the alternative investments used in such an evolved portfolio would be beta reduction alternative investments, not alpha focused alternatives such as private equities.

This portfolio would have similar volatility with a much higher expected return. We believe that traditional fixed income will only reduce volatility, but will not meet investors income or return needs. Combining stocks and bonds with liquid alternatives will deliver returns to the clients that will meet their long-term investment needs at a level of volatility they can withstand.

The next 10 years will be about getting the return portion of risk allocation right.

Bonds

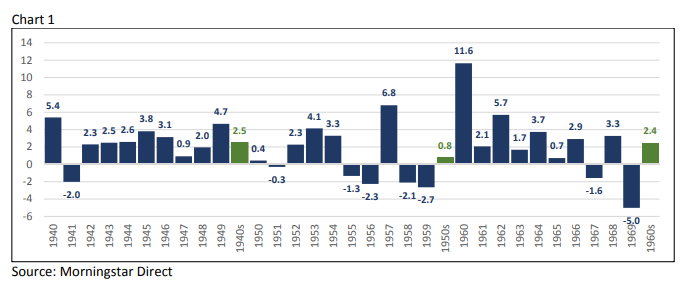

Interest rates are as low as they have been in the history of our country. We are here once before. Just as the Federal Reserve Bank lowered Fed Funds rates to zero in 2008, they did the same after the 1929 depression. Rates stayed low through the 1940s and then rose in the 1950s. Chart 1 shows the annual and annualized decade returns of the 10-year U.S. Treasury for the 1940s, 1950s and 1960s.

What this period meant for Bond investors was an annualized return of 1.65% for the first 20 years and 1.9% annualized return for the 30-year period. Now it is true one could have gotten higher returns in corporate bonds, but not much higher.

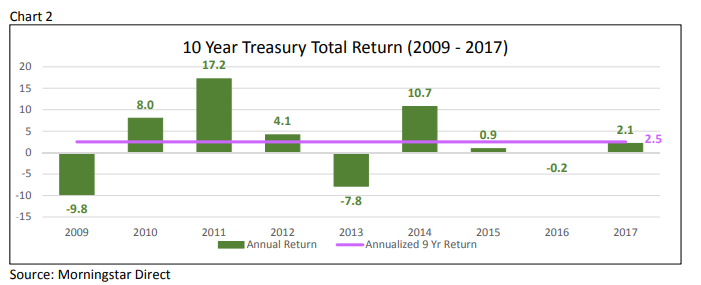

We are living this, at least the 1940s part, today. Chart 2 shows the annualized return of the 10-year U.S. Treasury over the last 9-year period. The 10-year yield on 12/31/08 was 2.25% and closed 2017 at 2.40%. The last 9 years have seen the exact return from the bonds that investors achieved in the 1940s.

RIAs have relied on fixed income to produce income and reduce the volatility of one's total portfolio. Today fixed income continues to provide both benefits. The problem is the income level does not meet most investors' needs for either income or implied total return. Almost all the clients of our RIA firms cannot achieve their investment goals with the current and implied future returns from fixed income.

To solve their problem, many investors have included High Yield as part of their fixed income portfolio, and to date it has worked well. The 10 Year Treasury annualized at 2.5% over the last 9 years, High Yield has averaged 12.7%. Now it is worth noting that over half of that return came in 2009. And for those who bought the lower rated parts of high yield, below B rated bonds, they were rewarded at even a higher level.

We have two problems with this solution. First, High Yield securities are not safe, fixed income investments. Now technically they are fixed income, but the asset class with the highest correlation to High Yield is domestic small cap equities, so historical volatility in this asset is much higher than investment grade.

Our second problem with High Yield deals with our definition of risk. We believe risk is not just the standard deviation of an asset class or its maximum draw down. We believe the prudent definition of risk lies in an analysis of what could have happened but did not. For example, the price of oil fell from $101.87 to $34.37 from July 2, 2014 to January 20, 2016. Oil then rose in 2016 to $56.85. What would have happened if oil stopped at $35 and did not rise? Many high yield investments would have been devastated. So, we do not know if investors dodged a bullet, but we do know that no one would feel as comfortable with high yield today if oil had not rebounded.

There is one more observation on High Yield. While the 10-year compounded at 1.6% over the last five years, High Yield returned 9.8%. Spreads today are narrow, and this party is over.

We think this is the biggest investment issue investors face today. One cannot rely on fixed income as we have in the past. Projected returns of 2.5% or slightly more will not solve clients' investments return needs. Investors need to have less, if any, fixed income in their portfolios.

Share this

- November 2025 (1)

- October 2025 (1)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- May 2024 (2)

- April 2024 (2)

- March 2024 (1)

- February 2024 (1)

- January 2024 (2)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (3)

- June 2023 (4)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

.png?width=2167&height=417&name=Greenrock-Logo%20(1).png)