Share this

Fixed Income Market Review - August 2023

by Bob Southard on Aug 31, 2023

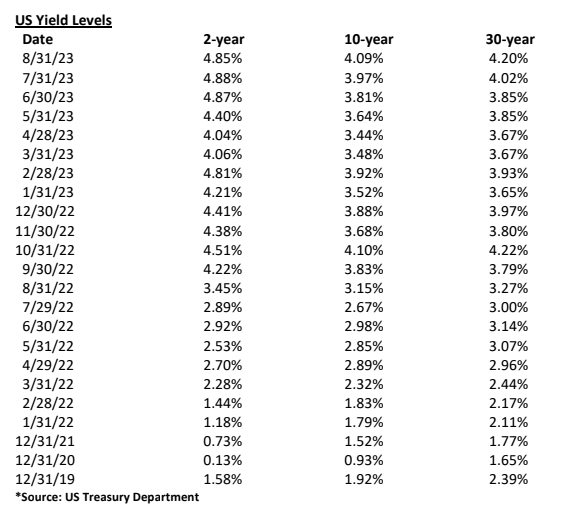

Like June and July when short rates generally held steady as the Fed continued its tightening cycle, and intermediate and long maturity rates rose, August saw much the same interest rate curve movements.

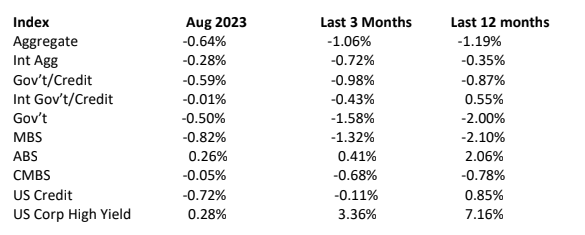

Bloomberg Barclay's Fixed Income Index Returns

High yield credit continued to do reasonably well. The Mortgage Market Asset Class had continuing problems with rising Mortgage Rates.

August Economic News

Repeating the focus of the Addendum I added at the end of the July Review, on August 1st Fitch Ratings downgraded the US Credit Rating from AAA to AA+. Fitch cited its rationale to be a steady deterioration in standards of governance referencing the January 6th insurrection, the last-minute debt ceiling agreement and the high growing government debt burden. The Administration as expected strongly disagreed with the downgrade.

On a personal basis, I agree with this step by Fitch. Fitch now has US Government debt below the rating levels for Germany (which now has financial problems) and Switzerland. In 2011 S&P downgraded US government debt to AA. S&P still has the US Government debt at this AA level. Though this number will be revised later in the month, on August 8th GDP was reported by the Commerce Department as up 2.4% for the 2nd Quarter compared with a rise of 2.0% in the 1st Quarter. The revision for this 2nd quarter number was reported on August 30th to be 2.1%. The major adjustments that lead to the downward revision of the first estimate were business investment was revised down to 6.1% from 7.7% used for the first estimate and consumer spending was revised slightly higher.

On August 8th the National Federation of Independent Business Survey reported for June, 30% of those surveyed were expecting better business conditions, the highest since August 2021, but well below historic average levels. From the survey 42% of employers were finding jobs hard to fill and 92% were finding few or no qualified job applicants for available jobs. Again on August 8th, Moody’s warned it was considering cutting the credit ratings of six big US banks including Bank of NY, Mellon, State Street, and Northern Trust. Further it warned it was considering downgrading 10 smaller US banks including in my Buffalo NY home area, M&T Bank Corporation. Strangely I feel somewhat relieved that none of the banks I use were not names mentioned, though I know that feeling of relief is stupid as to the economic impact such downgrades would have.

As a final news item from the 8th, the Federal Reserve Bank of New York reported US credit card debt rose 4.6% hit a record $1 trillion. Overall household debt rose 1% for the quarter to $17.0 trillion. This amount has risen $2.9 trillion since the start of 2020.

During the pandemic 14 million individuals refinanced their homes, extracting $430 billion. During the 2nd Quarter 2023 15,950 individuals made hardship withdrawals from 401k accounts, a rise of 36% in such withdrawal activity compared to the 2nd quarter 2022. Finally moving to a new announcement date, on August 10th the Bureau of Labor Statistics reported the CPI had increased by 3.2% over the last 12-months, though the increase was only 0.2% for the month of July. The core CPI increase for July was also 0.2% and the rise for the period 12-month period was 4.7%.

On August 11th the Bureau of Labor Statistics reported the PPI rose 0.8% for the last twelve- month period. July was up 0.3%, the highest month increase since January. Food prices had declined for three straight months coming into July, but July was up 0.5% and the trailing twelve-month rate 6.3%.

Also announced on August 11th, the Universe if Michigan Sentiment Index fell to 71.2 in August from 71.6 in July. The expectation for the GDP reported in the Index for the upcoming year period was 3.3% compared with 3.4% from the prior month. On the 11th the Atlantic Federal Reserve projected the 3rd Quarter GDP to rise by 4.1% from 2.4% in the 2nd Quarter.

On August 17th CNN reported rates for conforming first mortgages had risen in August to 7.09%, up from 6.96% in July and compared to 5.13% a year ago. The rate has been above 6.5% since May, and except for 7.13% in April 2022, is the highest rate in 21 years.

Though I won’t have a separate section this month for bitcoin, of note, Elon Musk’s Space X sold its bitcoin holdings and on August 18th the price of bitcoin dropped nearly 9%. Approximately $1 billion being drained from bitcoin holdings that day. The closing price was $26,327, this being 16% below the closing price on the prior Friday.

On August 21st S&P downgraded five banks: Key Corp, Comerica, Valley National, UMB

Financial, and Associated Banc-Corp. All were reduced one rating notch.

On August 22nd the National Association of Realtors announced prices for existing homes rose by 1.9% in July over the last year, after five straight declines. There were only 1.1 million existing homes for sale, the lowest number ever recorded in the month of July. One-third of home sales in July were made above the asking price level. One-quarter of sales were made for cash. 30% of July sales were to first-time buyers.

On August 22nd CNN Business brought up a possible problem about the Chinese economy. In 2021 a Chinese business, Evergrande defaulted raising questions whether this default might start a crisis in real estate in China. On 8/22 CNN reported on the default of Country Garden, once China’s largest developer.

CNN also identified the fact ZHOU Group Trusts had defaulted. This was a very major Chinese Trust company. I expect CNN Business will stay on top of what may be a major developing problem for the mainland Chinese economy.

On 8/25 the University of Michigan Consumer Sentiment Index was reported dropping to 69.5, a level well below earlier this year. The Consumer Confidence Borad Index was reported on 8/25 at 106.1 for August, down significantly from 114 for July. Also reported was the survey’s expectation for inflation declined slightly to 3.3% for August, from 3.4% in July, Consumer spending was reported up 0.5% for June from 0.2% for May.

On 8/25 Chairman Powell reported from the annual meeting in Jackson Hole that rate rises remain on the table after the pause by the Fed in June. He stated the Fed is looking for a below trend growth rate. Powell again stated the 2% inflation rate goal remains in place.

On 8/29 S&P Case Shiller US Home Price Index reported home prices went up in June by 0.7%.The report stated this increase placed prices on a year-over-year basis only 0.02% below the all-time high.

As a couple of surprising but interesting numbers:

- Applications for mortgages dropped during August to a 28-year low,

- For 20 European countries, their combined one-year CPI was reported as 5.3% with the Core CPI also at 5.3%,

- During July Germany's business economy suffered its steepest one month decline in more than 3-years,

- The ECB raised rates for the ninth consecutive time bringing the benchmark to 3.75%,

- During June China reduced its exposure to US Government debt by $103 billion (representing 11% of China's US Government holdings), to a 14-year low.

My Economic Outlook

The following is a direct quote from my June Review “Well, we have a Federal Debt Bill in place and the stock market has taken off in a rally, with that enormous risk avoided for a limited time. Limited time is the crucial word as we will shortly be again facing for Congress the deficit issue. Separately it is time Congress quickly take up the long-term funding requirements for Social Security and Medicare. I continue to suggest these issues need to be addressed before we fully enter the 2024 election cycle. Without concrete solutions the two programs will soon be approaching bankruptcy and likely become a political football between the two parties.”

Of course, nothing happened in July and now also August in Congress about Medicare and Social Security. Fortunately, the economy is continuing to click along at a sound level and though I believe the Fed is making a mistake in continuing to raise rates with inflation ticking down at an okay level, I feel fixed income will provide reverse the current trend and start providing positive returns.

I fear as we get ever closer to the election the division between the Parties will erupt ever further and the markets will be in turmoil. I feel this turmoil will drive fixed income to additional months of negative returns and the already flat yield curve, will see the yield of the 10-year 100 or more points above its current level.

Share this

- November 2025 (1)

- October 2025 (1)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- May 2024 (2)

- April 2024 (2)

- March 2024 (1)

- February 2024 (1)

- January 2024 (2)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (3)

- June 2023 (4)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

.png?width=2167&height=417&name=Greenrock-Logo%20(1).png)