Share this

Fixed Income Market Review - January 2023

by Bob Southard on Jan 31, 2023

As we have left 2022, the worst calendar year return for the bond market in history, what is ahead for 2023? The market believes inflation is still a major risk, and if not inflation, then a recession. In the face of these economic concerns, with Germany, England and the US sending tanks to Iraq to counter the Russian invasion, the doomsday clock is shifting ever closer to midnight.

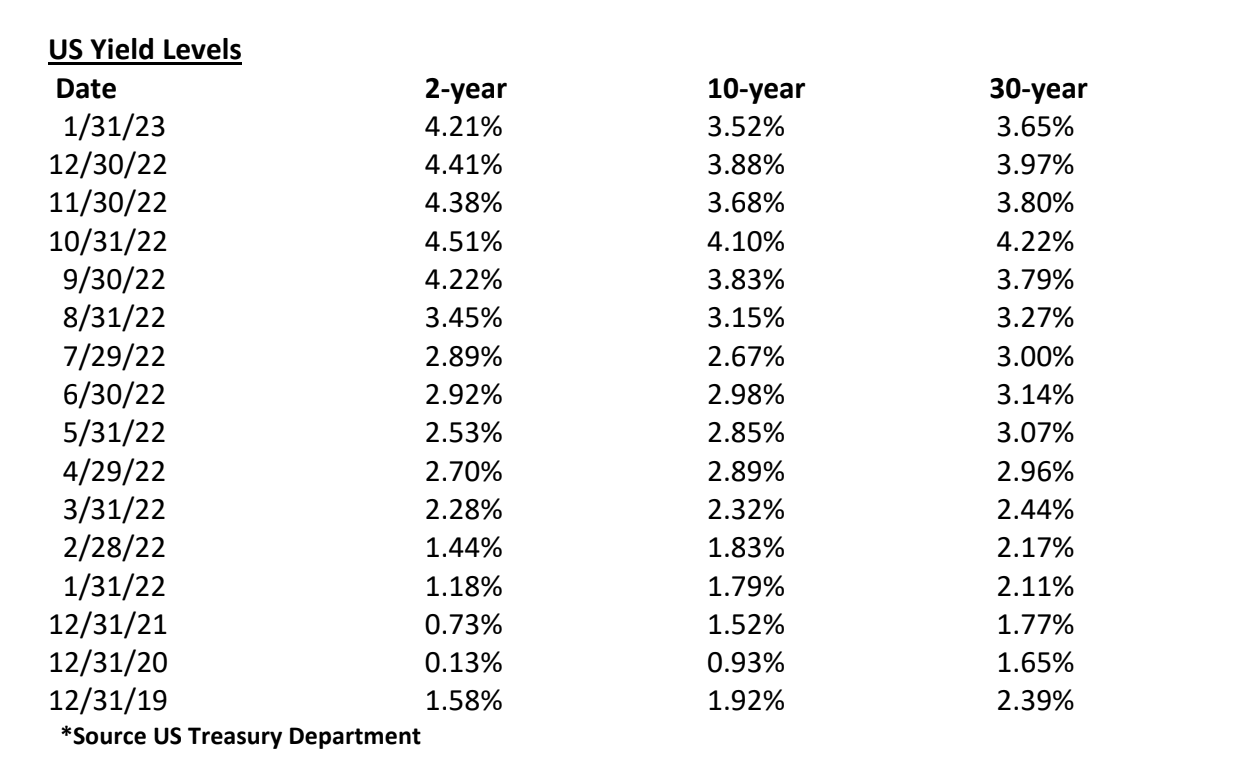

Please note though rates are much higher this month compared to last month, the yield curve continues to be very inverted between not only 2 and 10-year, but also between the 2-year and 30-year.

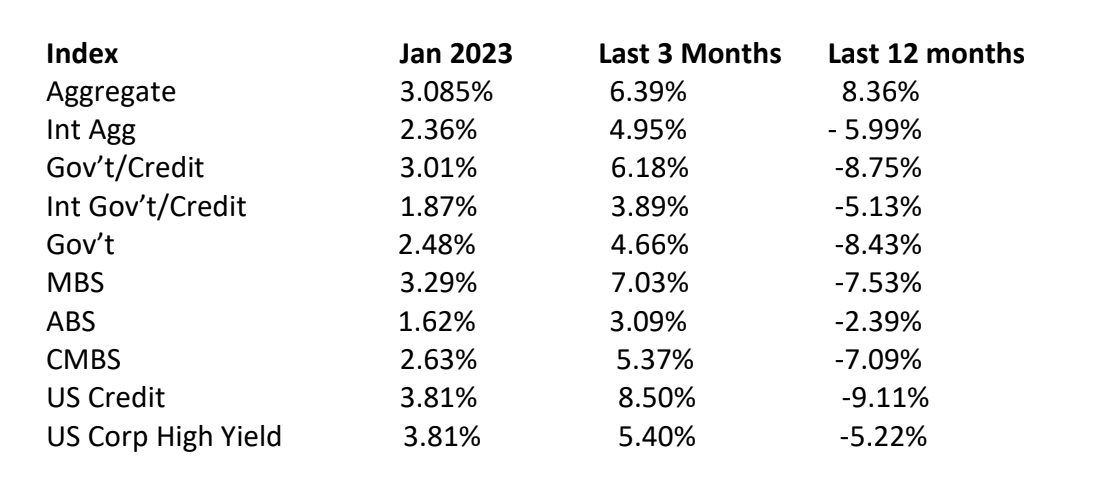

Bloomberg Barclay's Fixed Income Index Returns

Index returns for January were decently positive after 2022 having been the worst return calendar year for the bond market in history.

January Economic News

The primary question of the market remains, are we heading into a recession? Repeating from last month’s Review, on December 2nd the Department of Labor reported 263,000 jobs were added during November. The Unemployment rate for November held steady at 3.7%. Payroll gains for September were revised down by 46,000 to 269,000 but October was revised up by 23,000 to 284,000. As stated in that December Review the Labor market seemed solid to me.

Then on January 2nd the Department of Labor reported nonfarm payrolls increased by 223,000 during December. The November number was revised down but only by 7.000 from the initial estimate. The unemployment rate fell by 0.2% to stand at 3.5%. Average hourly wages were reported to be up by 0.3% for the month and 4.6% on a yearly basis. This is good in being positive but not too high.

As to inflation, on January 9th the NY Fed reported its December Survey of Consumer

Expectations indicating US households expect weaker near-term inflation and are expecting to do significantly less spending even as they expect incomes to continue to rise. The survey projected inflation at 3% per year for the next three-year period and at 2.4% per year for the upcoming five-year period.

As to the actual CPI, it was reported with a 0.1% decline for the month of December with an increase of 6.5% from a year earlier, down from 7.1% yearly number in November. The Core CPI saw a 0.3% increase which lowered the annual core increase from 6% to 5.7%.

Looking to Russia, it was reported on January 11th that Russian revenues from fossil fuel exports collapsed in December with the EU oil ban and oil price cap moving into place. The estimate is the EU’s action costing Russia 160 million Euros per day. However, Russia is still reported as making 640 million euros per day from exporting fossil fuels.

On January 11th the average contract interest rate for conforming 30-year mortgages decreased to 6.42%, down from 6.58%. This decline immediately sparked a 5% increase in applications to refinance home loans. But this result is with the rate one-year ago having been 3.52%. Separately mortgage applications for purchase homes were 44% lower than at the same time last year. The current reading is at the lowest level since 2014.

Following up on this set of numbers, home sales were reported to have ended 2022 at 4.02 million units, a result 34% lower than December 2021. Home sales were lower for the 11th straight month. Housing inventory fell during December by 13.4%, but was 10.2% higher than December 2021. The historic average for first-time buyers is 40% but stood at only 31% for December. Homes are currently taking 26 days to sell up from 24 days in November and 19 days December 2021.

As reported on January 23rd, the average outstanding balance of credit card debt for

Generations Xers (ages 43 to 58) was $7,004 compared with $6,785 for baby boomers (ages 59 to 77), $5,928 for millennials (ages 27 to 42) and $2,876 for Generations Zers (ages 11 to 26). With the 3rd Quarter of 2022 credit card balances across all age groups totaled $930 billion, which was $121 billion more than a year ago, the largest annual rise in more than 20 years. The average monthly amount being paid toward the aggregated total debt is $430.

On January 27th, the Fed’s preferred measure of inflation, the core PCE rose 4.4% from a year ago. This reading was down from 4.7% for November and is the slowest annual increase since October 2021. Personal income rose 0.2% for the month and consumer spending dropped 0.2%.

It was reported that for December 1.5 million Americans missed work. For the past three-year period in excess of 1 million Americans called in sick. The last time the number calling in sick dropped below 1 million was November 2019. During 2022 there were 19 million absences for the year.

In a study from New York State, 71% of long Covid patients were unable to work for at least six months. One-in-five long Covid patients could not work for a year or longer after getting sick. Interestingly the majority were under age sixty. On average one in five Americans developed long Covid after their initial infection with 7.5% of all Americans currently experiencing long Covid.

January Cryptocurrency

From last month’s Review, the following sentence was included, “In the meantime remember the name Wintermute, a crypto trading firm I will write about at the end of next quarter.” Wintermute was principally founded by a Russian married couple. The firm name Wintermute came from an AI creature in the 1984 science fiction novel Neuromancer.

Wintermute’s initial focus was on terra USD (UST) a cryptocurrency stable coin with

approximately $15 billion in circulating coin. Wintermute principals believed algorithm-basedstable coins not backed by Government issued currencies were going to fail. They integrated their trading systems with Terra’s blockchain technology. When UST’s price dipped to $0.98 Wintermute began an arbitrage strategy to buy UST coin for below $1 and redeem it to the sister cryptocurrency, luna, which it quickly sold netting profit margins per trade of 10% to 15%. UST traded down to approximately $0.10 with Wintermute making tens of millions in profits.

With this type of arbitrage trading, as published by Forbes on December 20th in Digital Assets, during 2021 Wintermute totaled $1.05 billion in revenue and $582 million in profit. In 2022 a decentralized trading platform, Uniswap rose from $10 million in daily trades during May 202 to $1 billion of daily trades three months later. Wintermute began making heavy use of Uniswap. However, FTX had an impact on Wintermute as it had $59 million with FTX. Also, Wintermute suffered a $160 million hack with one of its digital wallets and likely did not produce a profit during 2022. Nevertheless, at year-end Wintermute was still racking up $1 billion a day in trades.

The bottom-line is they have experienced losses but from what I have seen will remain as one of the major cryptocurrency firms going forward. They merit a close watch in future years. On a less positive basis about the cryptocurrency industry, on January 6th it was announced the New York State Attorney General filed a civil lawsuit against bankrupt cryptocurrency lender Celsius Networks, and its former head Alex Mashinsky. The charge is Celsius made false and misleading statements encouraging investors to place billions of dollars with Celsius. The lawsuit alleges Mashinsky touted Celsius as safer than a bank and high returns would be made through low-risk, collateralized loans to established institutions and crypto exchanges.

However, Mashinsky was reported to have made $1 billion in loans to FTX accepting the FTX token, FTT, as collateral.

It was reported on January 12th that the SEC is charging Gemini and Genesis with not regulating their companies as a security and in the process bypassing the disclosure requirements created to protect investors. The amount of damages being sought by the SEC is not yet specified.

On a “possible” positive basis, an attorney for FTX reported FTX representatives have located over $5 billion of cash, liquid cryptocurrency and liquid investment securities. This attorney indicated the $5 billion does not include assets seized by the Securities Commission of the Bahamas. But the bankruptcy court for FTX was told the extent of losses to customers is not known.

As another “possible” positive crypto event, on January 11th Binance announced it was on a hiring spree to add 15% to 30% to its work force. Other exchanges are cutting large numbers from their staffs with $1.4 trillion wiped off the crypto market in 2022.

A Personal Observation

Having grown up in the 50’s and 60’s, I always considered the center of the automobile industry to be Detroit with Ford, General Motors and to a lesser degree Chrysler being the foundation of that universe. That focus began to weaken when soon after my wife and I married, we bought a Japanese Mazda which we appreciated being able to climb any mountain of snow, since we had not yet moved from the Buffalo area. Even years later when my fixed income shop Allegiance Capital was in a finals to manage Ford motor assets, I was highly impressed by the Ford dominated parking lot at Ford in Detroit and how dumb I had been to dive a foreign rental car into that lot.

But on January 23rd I read a Businessweek article stating China is poised to become the number 2 exporter of passenger vehicles, having gone by the US and South Korea to third place and about to exceed Germany for second place. Japan remains in first place.

The article states overseas shipments of cars in China have tripled since 2020 to reach 2.5 million last year. This places China ahead of the US and South Korea, and just slightly behind Germany, with Japan in the lead. The article goes on to state Chinese brands are the leaders in the Middle East and Latin America. China’s stated target is to sell 8 million vehicles a year by 2030.

Does the US have any similar goal? I would suggest not and believe it is a major competition problem we in the US need to begin addressing.

Staying with China but moving beyond the automobile industry, on January 13th Goldman Sachs raised its growth forecast for 2023 for China’s economy from 4.5% to 5.3%. Goldman does expect this increased growth will add to inflation but only to 1.9% for China in 2023.

My Economic Outlook

Borrowing from February, on February 2nd the Federal Reserve did increase interest rates but by its smallest increase in the current cycle at 1⁄4%. It did indicate the Fed is not yet done but I fully expect it will at most be only one more increase. The Bank of England raised its key rate on February 1st by 1⁄2% but signaled it may soon pause.

I believe the Fed after one more increase will be finished raising rates. Inflation is likely done. Though the US housing market is weak and personal spending has not yet recovered from the pandemic, a recovery is taking place. So long as the Republican Party does not force huge budget cuts and allows the increase in the national deficit, the economy will not enter a recession.

Though we have had back-to-back years of negative performance from the bond markets, I believe 2023 will provide very decent returns.

Disclosure

Greenrock Research is a registered investment advisor.

The information provided herein is intended for financial professionals and represents the opinions of Greenrock Research management, and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance is not necessarily indicative of future returns and the value of investments and the income derived from them can go down as well as up.

Our views expressed herein are subject to change and should not be construed as a recommendation or offer to buy or sell any security or invest in any sector and are not designed or intended as basis or determination for making any investment decision for any security or sector.

There is no guarantee that the objectives stated herein will be achieved.

All factual information contained herein is derived from sources which Greenrock believes are reliable, but Greenrock cannot guarantee complete accuracy.

Any charts, graphics or formulas contained in this piece are only for the purpose of illustration.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited.

Share this

- November 2025 (1)

- October 2025 (1)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- May 2024 (2)

- April 2024 (2)

- March 2024 (1)

- February 2024 (1)

- January 2024 (2)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (3)

- June 2023 (4)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

.png?width=2167&height=417&name=Greenrock-Logo%20(1).png)