Share this

Fixed Income Market Review - June 2023

by Bob Southard on Jun 30, 2023

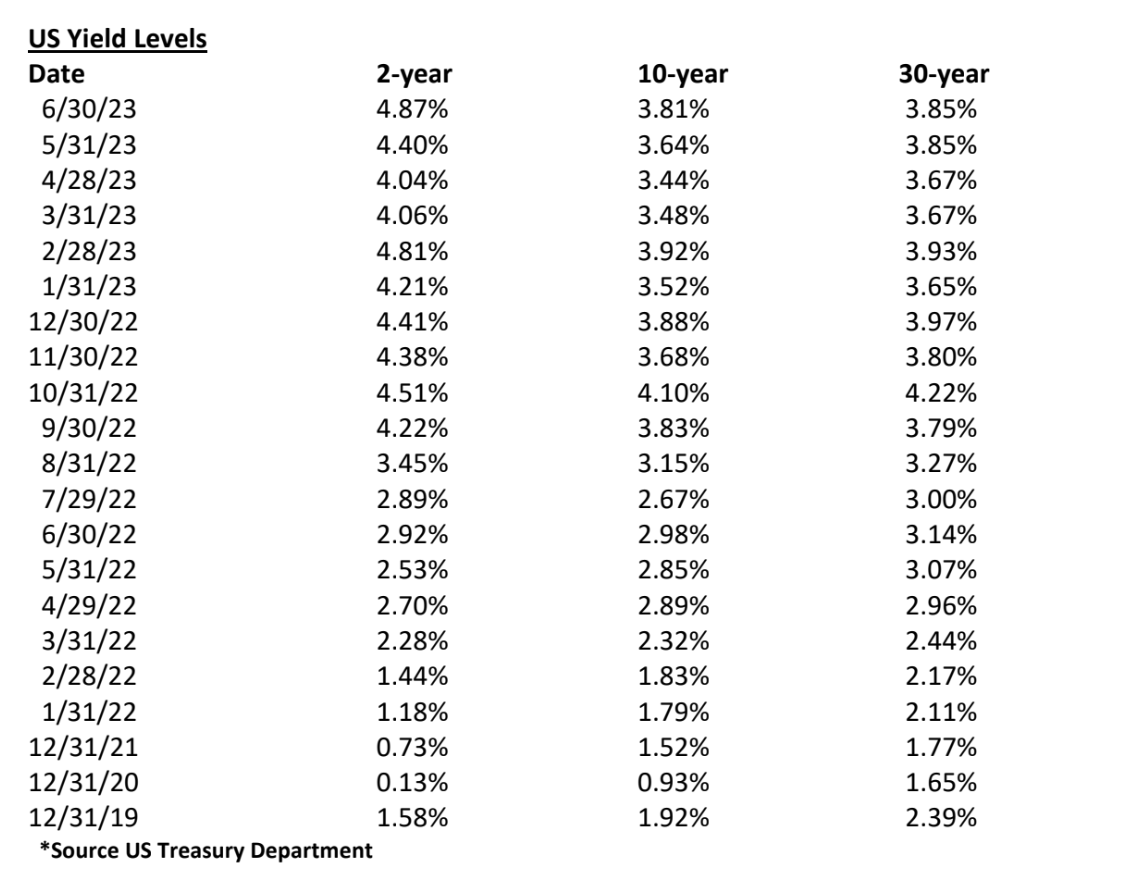

Interest rates rose for the front and intermediate portion of the curve but held steady at the long end of the curve. The 2-year yield was near the level it was at six months ago on 2/28/23, and the 30-year yield was slightly below the level it was on 2/28/23. The yields of the 2-year and 10-year remain inverted as they have been since July 2022.

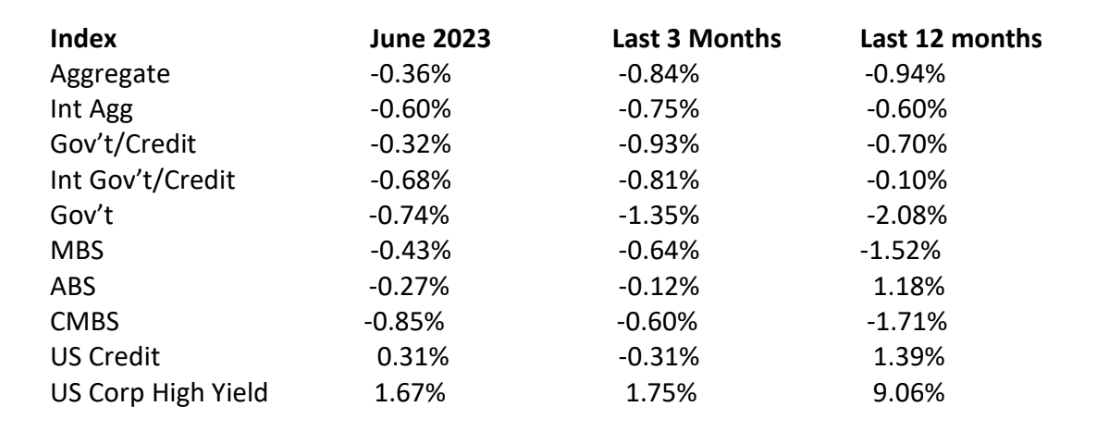

Bloomberg Barclay's Fixed Income Index Returns

With long maturity yields remaining steady for June while short and intermediate yields rose, credit and high yield posted positive returns and everything else had negative results, even including shorter maturities such as ABS and MBS issues.

June Economic News

Though I included in last month’s Review information about Credit Suisse’s and First Republic Bank’s problems, I will repeat those items since they happened during June. Further, the actions by the Swiss Government with Credit Suisse and the Fed and JP Morgan’s actions supporting the First Republic bank failure seemed to put a cap on the concerns about major bank failures.

Restating the Credit Suisse failure, on June 9th it was announced UBS and the Swiss Government would perform an emergency takeover of Credit Suisse and share in losses that might result. I had some knowledge for years that Credit Suisse had financial and management problems, but the need for this takeover was still surprising.

I found it surprising since it is now public knowledge negotiations were actively progressing since March 2023 on the rescue. The arrangement is UBS will cover the first 5 billion francs of losses it might suffer in the sale of Credit Suisse assets, with the Swiss Government covering excess losses up to 9 billion Swiss Francs.

As a term of the agreement, Credit Suisse must keep its headquarters in Switzerland. Further efforts have been made to be certain Swiss taxpayers do not pay for this deal.

Documenting the First Republic Bank issue, it lost $100 billion in deposits soon after the collapse of Silicon Valley Bank. JP Morgan assumed control of the remaining $92 billion of First Republic’s deposits, plus most of its loans and securities, with the FDIC sharing losses on these securities. Though this agreement does protect the Bank’s depositors, it wipes out all value for the Bank’s shareholders.

As to the US inflation picture, on June 27th the Council of Economic Advisors published their effort to provide an apples with apples comparison of inflation levels. The report determined that US inflation peaked at about 10% last summer and has now declined to below 3%. The report indicated inflation in Japan and Canada is 4% and the UK and Italy at 8%.

However, a USA survey reported on 6/28 found 52% of the US population find the US to be too expensive to live in. A Pew Center report published the same day indicated 7 of 10 Americans find inflation and the economy to be the number one US problems. But the University of Michigan consumer sentiment Index rose from 59.2% in May to 63.9% in June.

However, though consumer sentiment seems to be positive, USA Today reported in June the delinquency rate on bank credit cards at the end of May was 3.27%. This is the first time in the current economic environment it has been above 3%.

As to employment, on June 2nd the DOL reported a robust job increase for May of 339,000, though the unemployment rate rose from 3.4% to 3.7% as workers returned to the active labor force. The VIX number declined to 14.6, the first time it has closed below 15 since February 2020.

The BLS June report indicated wage growth slowed in May with average hourly earnings rising 4.3% on a year-over-year basis, nearly identical to the 4.4% increase through April. As to the most recent monthly number, hourly wages grew by 11 cents, representing a 0.3% increase to $33.44.

As to further strengthening the employment picture, with the June employment report prior monthly employment reports were revised upward as March was revised up from 165,000 to 217,000 and April up from 253,000 to 294,000. Backing up these strong employment reports, BLS reported the ratio of vacancies to unemployed stands at 1.8, well above the 1.0 to 1.2 level judged to be normal.

Though the unemployment reports look positive, on June 24th Moody’s Investors Service reported corporate defaults rose during May, reaching a total of 41 so far in 2023. This number was more than double the number of corporate defaults that occurred for the same period in 2022. Moody’s also reported the number of personal bankruptcy filings in the US so far in 2023 were at a level not seen since 2010.

Separately Moody’s is projecting the global default rate to rise to 4.6% by the end of the year, then to 5% by April 2024. The historic average global default rate is 4.1%.

Cryptocurrency

To repeat a news item from last month’s Review, on June 6th the SEC sued Coinbase for

operating as an unregistered exchange and broker, indicating 13 issues listed on its platform were considered crypto asset securities. This action came one day after the SEC sued Binance and its founder Changpeng Zhao.

With these actions, the SEC has made it clear it considers crypto exchanges to be Securities with one major exception, this being bitcoin. The reason for the bitcoin exception seems to be since bitcoin trades on the Chicago Mercantile Exchange which is regulated, bitcoin is being viewed as a commodity, a position with which I am not in love.

During 2021, bitcoin traded to a high of approximately $60,000 per coin. With the bank industry defaults and increased regulatory steps impacting the crypto market, bitcoin traded below $30,000 per coin through early 2022. On June 23, bitcoin rose to $31,400, this being the first time it was above $30,000 per coin since April 2023. What drove this rise? First Black Rock registered for a bitcoin exchange traded fund (ETF). Then EDX Markets, backed by Schwab, Fidelity and Citadel launched a digital asset trading platform. Also, we had no more bank failures as recovery steps stemmed the tide for at least the time being!

Are we out of the woods and cryptocurrency has returned to a firm footing? I had clients whose equity component away from the fixed income we managed were impacted by the Madoff scandal. In many ways cryptocurrency reminds me too much of Madoff though I desperately hope I am wrong.

My Economic Outlook

Well, we have a Federal Debt Bill in place and the stock market has taken off in a rally, with that enormous risk avoided for a limited time, it is time Congress quickly take up the long-term funding requirements for Social Security and Medicare. I would suggest these issues need to be addressed before we fully enter the 2024 election cycle. Without concrete solutions the two programs will soon be approaching bankruptcy and likely become a political football between the two parties.

Apart from the funding of these two entities becoming the primary current focus of the fixed- income markets, I see decent returns for fixed income over the next quarter period. Political attention seems to have shifted to decisions coming from the Supreme Court. with those decisions regardless of how major they are, not likely to drastically shift the financial markets. By September, however, I believe all bets will be off and politics will begin to have a tremendous impact on market investment returns. Volatility will likely become enormous.

Disclosure

Greenrock Research is a registered investment advisor.

The information provided herein is intended for financial professionals and represents the opinions of Greenrock Research management, and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance is not necessarily indicative of future returns and the value of investments and the income derived from them can go down as well as up.

Our views expressed herein are subject to change and should not be construed as a recommendation or offer to buy or sell any security or invest in any sector and are not designed or intended as basis or determination for making any investment decision for any security or sector.

There is no guarantee that the objectives stated herein will be achieved.

All factual information contained herein is derived from sources which Greenrock believes are reliable, but Greenrock cannot guarantee complete accuracy.

Any charts, graphics or formulas contained in this piece are only for the purpose of illustration.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited.

Share this

- November 2025 (1)

- October 2025 (1)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- May 2024 (2)

- April 2024 (2)

- March 2024 (1)

- February 2024 (1)

- January 2024 (2)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (3)

- June 2023 (4)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

.png?width=2167&height=417&name=Greenrock-Logo%20(1).png)