Share this

Fixed Income Market Review - March 2023

by Bob Southard on Mar 31, 2023

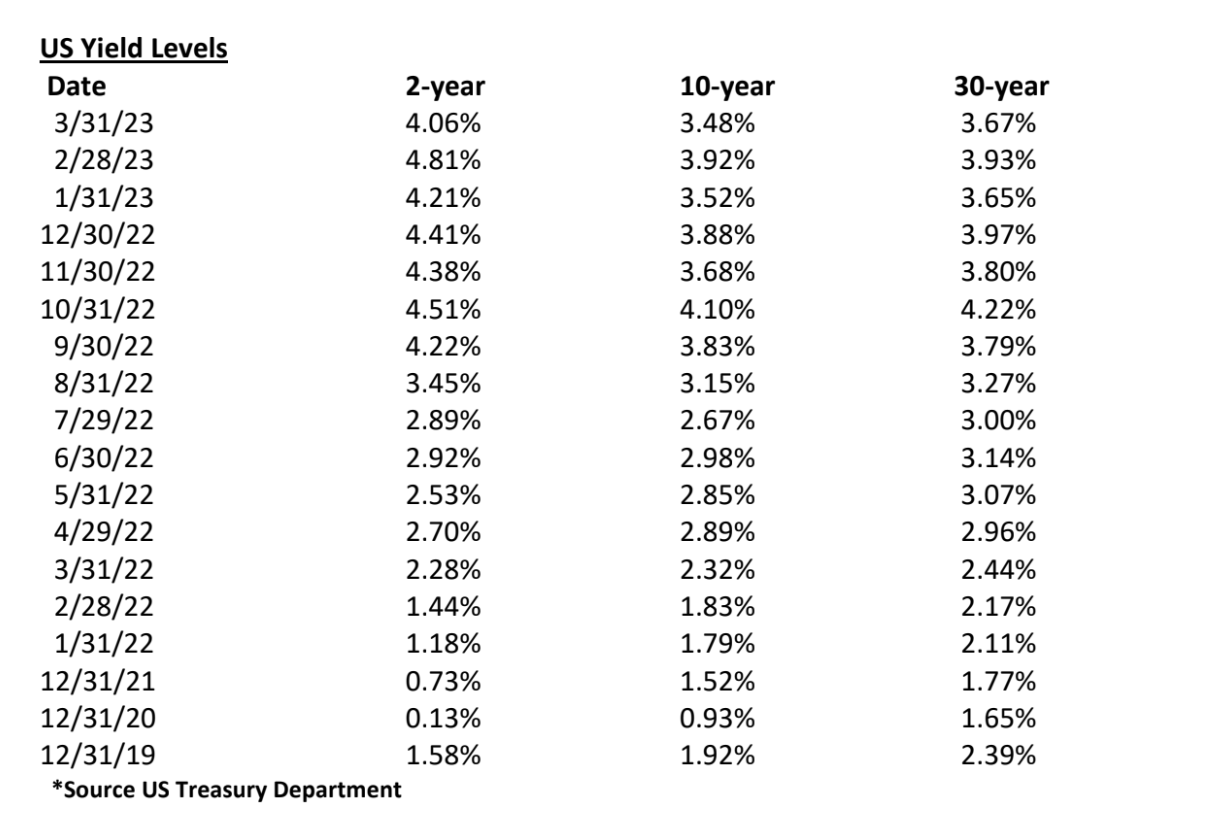

The Fed continued to tighten during March in the face of major bank failures, though the failures may have led to the tightening steps backing down to the 1⁄4% level. The yield curve continues to be inverted in both the 2/10 and 2/30 yield levels.

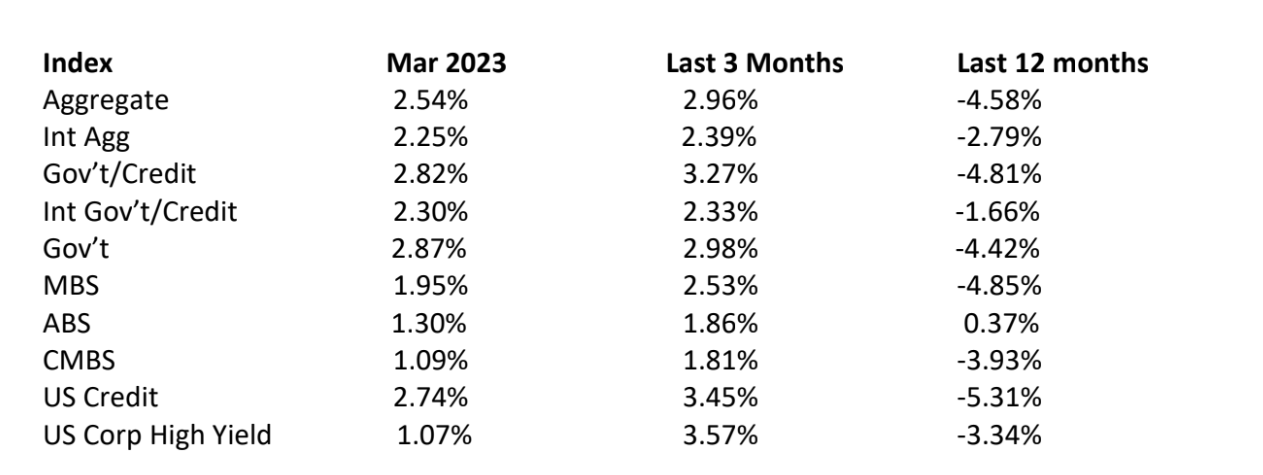

Bloomberg Barclay's Fixed Income Index Returns

Though the Fed has continued to tighten rates, returns for February were very, very negative. Since the start of March, returns have returned to a positive level and I expect will continue to be positive for much of the rest of 2023.

March Economic News

The January unemployment report had supported the Fed statement of “robust” job gains as nonfarm payrolls had increased by a huge 517,000 in January. The unemployment rate fell to a historic low of 3.4%. The unemployment report for February indicated a smaller gain than January, but still a significant 311,000. The unemployment rate rose to 3.6%, the rise reflected a higher labor force participation rate.

The US Labor Department JOLTS report for December had reported 10.824 million job

openings. The JOLTS report for January reported job openings declined 410,000 from December but was still equal to 1.9 job openings for every available worker.

These reports are to me a double-edged sword. The continued strong levels for job gains indicate the economy is growing and not likely to enter a recessionary cycle. The fact that the job market is tighter than historic levels is leading economists to suggest an upside risk to prices and wages. Focusing on wages, they rose in February by just 0.2% compared to January and were up 4.6% over the last twelve-month period.

I am personally on the side of economic growth correcting all ills. I partially base this opinion on booming consumer demand for services including dining out and the travel that is exploding from the pandemic restriction period. Even the construction sector added jobs, 24,000 for the month, despite the Fed’s rate hikes making the building and buying of homes more expensive. As to inflation, the NY Fed reported its December Survey of Consumer Expectations indicated US households expect weaker near-term inflation and are expecting to do significantly less spending even as they expect incomes to continue to rise. The survey projected inflation at 2.7% per year for the next three-year period and at 2.6% per year for the upcoming five-year period.

The Producer Price Index for final demand goods declined by 0.1% in February while for final demand services it declined by 0.2%. The Index for final demand rose 4.6% over the last twelve-month period.

The CPI was reported on March 14th to have increased by 0.6% for the month of February and by 6% over the last twelve-month period. The core CPI increased by 0.5% in February and by 5.5% on a twelve-month basis.

As to the consumer, on February 15th AP Economics reported consumer spending rose in January by the fastest pace in 2 years. Retails sales increased by 3% in January, the largest one month increase since March 2021. The largest contributing factor was car sales. The March report from AP Economics showed a slight decline of 0.2% for the month in consumer spending after the huge increase in January. To me, even with the high level of inflation in food costs consumer spending seems to be strong.

As to the housing market, on March 22nd USA Today reported homebuilding rose by almost 10% in February led by a growth in apartment construction coupled with an increase in single family home starts. Housing starts had been down for six straight months but in February increased by 9.8% for the month. The largest component in this increase was multifamily unit construction, jumping 24% for the month. Also bucking a five-month trend of rising, rents declined in February.

On March 22nd Reuters reported that after the failure of the Silicon Valley Bank, interest rates for US home mortgages fell by the largest percentage of the last four- month period. The average rate for the 30-year fixed rate mortgage fell to 6.48% from 6.71%. Mortgage loan applications surged as a result. This decline was expected to be short-lived with the Fed expected to tighten again.

On March 23rd the Bank of England raised rates by 1⁄4% though it did state it expected the level of British inflation to begin to cool in a fairly quick fashion. This takes the British Bank rate to 4.25%. With a coincident level of timing the European Central Bank raised rates, but by 50 basis points.

The Crisis in the Banking Industry

I have debated whether to keep this separate to the banking industry or include it under the cryptocurrency heading. This is the March 15th collapse of the Silicon Valley Bank. The reason for being undecided about this decision is SVB is so concentrated to small and midsize companies in the tech sector, particularly venture capital firms. SVB at its peak as working with 2500 venture capital firms.

As the Fed was raising rates, these clients began burning through cash, which SVB having invested in a barbell approach of short and long duration securities, was not able to accommodate the cash withdrawal activity that ensued. SVB had been the 16th largest bank in the US with $210 billion in assets. The collapse represented the second largest back collapse in history.

Soon after the collapse of SVB, customers of Signature Bank, a $110 billion commercial bank, began a run-on capital with customers withdrawing funds to move to larger banks. Neither SVB nor Signature were subject to the regular, in-depth reviews of their financial health, such as is the case for large banks. The FDIC sold most of Signature Bank to Flagster, sub of NY Community Bank. Flagster bought $38.4 billion of Signature assets, including $12.9 billion of Signature loans, paying just $2.7 billion for the purchase. Not included in the purchase as surprise, surprise: $4 billion in digital assets.

Of note, with this crisis approximately $7 trillion of deposits of US banks are uninsured by the US Government, representing 43% of total US bank deposits.

On March 23rd the publication, The Atlantic, had a very good article about “What Really Broke the Banks?” The article suggests though the Fed clearly wanted to continue raising rates, it chose to raise only 1⁄4% in light of the banking concerns. The article then ties the banking crisis to Covid. The article explains that with the rise of COVID-19 bank deposits soared. Bank deposits soared by 21.7% in 2019 then another 10.7% in 2020. By the end of 2021, bank deposits were $4.4 trillion larger than they had been two years earlier. With the pandemic, the demand for business loans cratered. Banks had nowhere to invest these riches.

Banks had no choice but to invest in government debt and be exposed to the “interest rate risk” of such debt. That interest rate risk materialized as the Fed, facing inflation, began a cycle of rising rates.

As one last note on SVB, on March 12th 300 venture capital firms signed a letter indicating a willingness to work with SVB under new ownership assuming proper capitalization exists. Then came Credit Suisse, though I knew of its troubles as far back as 25-years ago. The country of Switzerland bailed out the bank and the bank failures still being a great risk to the world economies have not spread to a significant degree.

March Cryptocurrency

An early shoe for cryptocurrency fell on February 8th as Binance announced it was suspending US dollar withdrawals for international customers. Millions of dollars of crypto flowed out of Binance but the company declared it remained “net-positive”. This activity applies only to non- US customers who transfer money to or from bank accounts in dollars. Using data from DefiLlama, net outflows totaled $172 million for the day, relatively insignificant for a company holding $42.2 billion in crypto assets.

Then on March 8th Silvergate announced it was liquidating the bank. Silvergate had been along with Signature bank one of the two primary banks for the crypto industry.

However, the likely major impact story for the crypto industry during 2023 I believe will be Coinbase (COIN). Two years ago, COIN received a notice from the SEC about a business practice.

COIN allowed users to lend out their crypto and earn interest in the process. COIN ceased this practice when they were told by the SEC it represented the selling of securities.

On March 23rd it was announced the SEC had issued a Wells notice to COIN. A Wells notice is given in advance of an enforcement action. Targeted with the notice are asset listings and staking by COIN.

COIN is the largest crypto exchange. The timing of the notice is very bad for COIN and crypto because bitcoin is up 46% in price since 3/10 SVB collapsed, with bitcoin being a possible alternative to bank deposits.

The last banking crisis to the current one was 2008 with the Federal Government being forced to bail out banks. Crypto emerged for the first time as a possible financial alternative. The SEC has become more active indicating with the exclusion of bitcoin, most crypto currencies are Securities. The SEC seems ready to apply the Supreme Court’s 1946 ruling, the Hovey Test which defines an investment contract and subjects such contracts to SEC Securities laws. The SEC is also focusing on staking in which investors lock up crypto tokens with a block chain validator resulting in the reward of additional coins. Last month, the SEC took action against the Kraken Exchange that was staking, indicating it represented the sale of securities. Kraken was fined $30 million and shut down its staking activity.

A Personal Observation: China

My last two reviews included discussions about China. Here comes my third. Forget about TikTok as there are more crucial concerns than are being debated in Congress about China. China’s acquisitions of US businesses set an all-time record in 2022, and is on a pace in 2023 to exceed that record. As an example, do you buy Smithfield Foods products? A Chinese firm bought Smithfield for $4.7 billion. Smithfield has facilities in 26 states directly owning 460 farms with contracts with 2100 others. 42% of Chinese corporate profits comes from companies in which the Chinese Government owns controlling interests. This last year a Chinese company spent $2.6 billion to buy AMC. The Golden Dragon Precise Copper Tube Group just broke ground on a $100 million factory in Thomasville, Alabama. Quizhou Grouchuang Energy acquired Triple H Coal in Jacksonboro Tennessee.

The US Trade deficit with China over the last decade is $23 trillion. 85% of artificial Christmas trees purchased in the US are manufactured in China. China produces 3 times as much coal per year and 11 times as much steel as does the US. Last but definitely not least, China has control of 95% of the world’s rare earth elements.

My Economic Outlook

On February 2nd the Federal Reserve did again increase interest rates, but by its smallest increase in the current cycle at 1⁄4%. The Fed did indicate it is not yet done but I fully expect it will at most be only one or at most two more increases. The Bank of England raised its key rate on February 1st by 1⁄2% but signaled it may soon pause.

I believe the Fed will soon be finished raising rates. Inflation is slowly coming down. The US housing market is stable and personal spending has recovered from the pandemic. Though credit card debt is high, the US economy will almost certainly not enter a recession.

Fixed income markets will not be negative for the 2023 year, even with the negative start for January and February. In fact, fixed income will likely be much more stable during 2023 than the stock market and may, in fact, beat the return of the stock markets during the calendar year.

Disclosure

Greenrock Research is a registered investment advisor.

The information provided herein is intended for financial professionals and represents the opinions of Greenrock Research management, and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance is not necessarily indicative of future returns and the value of investments and the income derived from them can go down as well as up.

Our views expressed herein are subject to change and should not be construed as a recommendation or offer to buy or sell any security or invest in any sector and are not designed or intended as basis or determination for making any investment decision for any security or sector.

There is no guarantee that the objectives stated herein will be achieved.

All factual information contained herein is derived from sources which Greenrock believes are reliable, but Greenrock cannot guarantee complete accuracy.

Any charts, graphics or formulas contained in this piece are only for the purpose of illustration.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited.

Share this

- November 2025 (1)

- October 2025 (1)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- May 2024 (2)

- April 2024 (2)

- March 2024 (1)

- February 2024 (1)

- January 2024 (2)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (3)

- June 2023 (4)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

.png?width=2167&height=417&name=Greenrock-Logo%20(1).png)