Share this

Fixed Income Market Review - July 2023

by Bob Southard on Jul 31, 2023

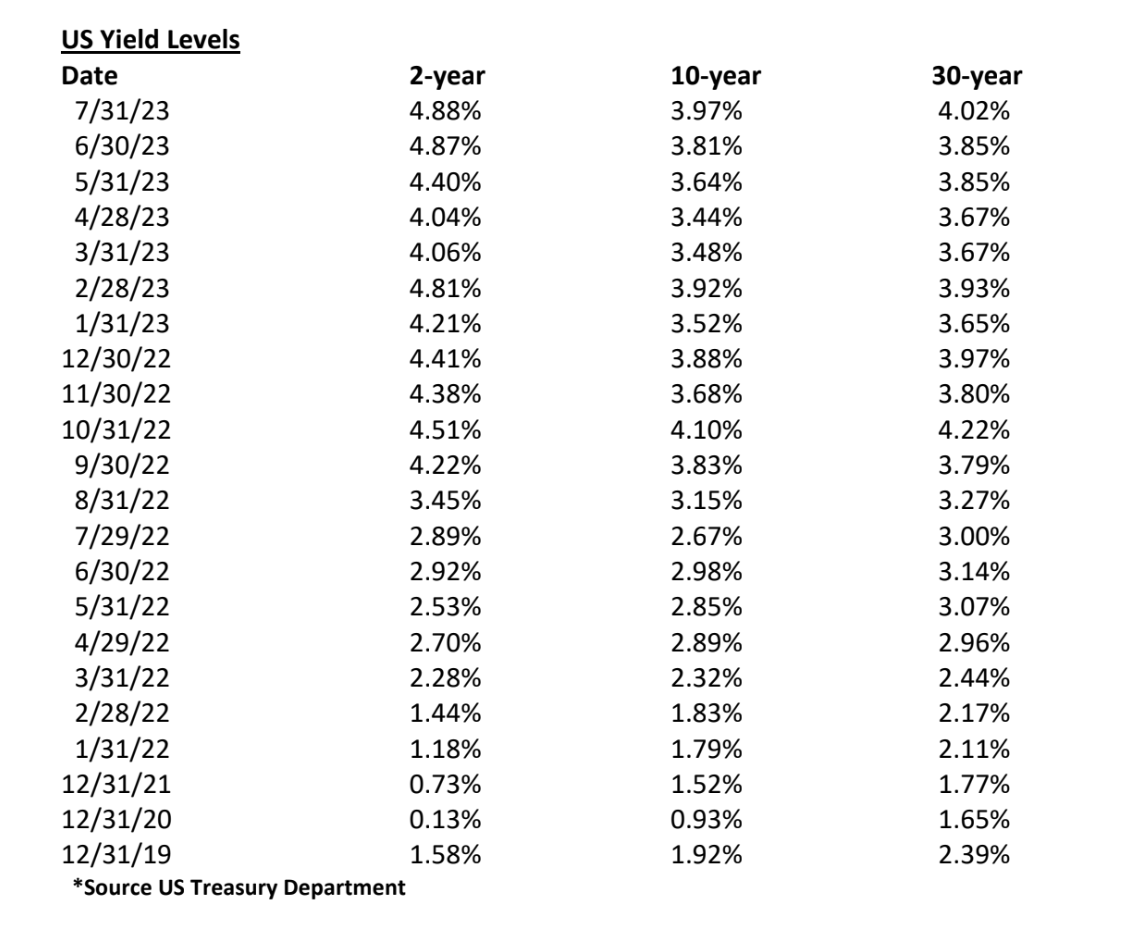

Unlike last month when interest rates rose for the front portion of the curve but held steady at the long end of the curve, the two-year rate as steady, and the intermediate and long rates were up by significant margins.

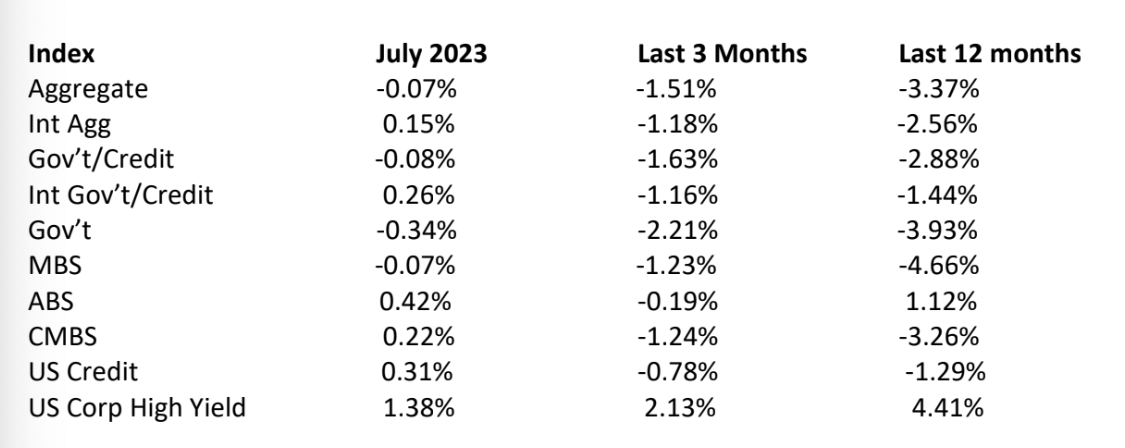

Bloomberg Barclay's Fixed Income Index Returns

Credit continued to do reasonably well, especially in the high yield category. The Mortgage Asset had continuing problems with rising Mortgage Rates.

July Economic News

As discussed last month, decisive actions had been taken to deal with the three bank failures, Silicon Valley bank, Signature Bank and First Republic Bank, that had so unsettled the banking industry. There was a new failure reported on July 28th, Heartland Tri-State Bank from Elkhart, Kansas, but with much less shock to the system. Heartland was reported with $139 million in assets and $130 million in total deposits, Heartland was a New Zealand owned bank created in 2011.

The FDIC was named Receiver and all deposit accounts and substantially all assets were transferred to Dream First Bank, Syracuse Kansas. This failure was judged to be so insignificant few people outside Kansas knew it happened with basically no national ripple effects. Even the shares of Heartland were owned by its holding company, Elkhart Financial Corporation, which was not included in the closing of the bank or resulting receivership.

On July 4th, the OECD reported year-over-year inflation in the G7 fell to 4.6% in May, down from 5.4% in April and its lowest level since September 2021. There was one outlier among the seven, this being Britian. U.K. consumer prices across all items rose by 7.9% in May compared with the prior year reading. Seemingly in response the BOE raised rates by 50 basis points to 5%, representing the 13th consecutive rate hike, taking the level to its highest since 2008.

Core inflation, excluding food, dropped to 6.9% in May, down from 7.1% for April. However, the pace of the decline has been at a slower rate than the rate of decline for the all-inclusive number.

On July 7th, the Department of Labor reported jobs added were 209,000 and the unemployment rate dropped from 3.7% to 3.6%. This reading is near a half century low level.

Revisions for prior months were for May down from 339,000 to 306,000 and the combination of March and April cut by a combined 110,000 jobs. For May the average hourly earnings rate increased by 12 cents to $33.58 and the yearly increase was up 4.4%. In May the average hours worked was down to 34.3 versus 35 in January.

On July 12th CNN reported inflation at 3% from a year June ago. Inflation had been reported at 4% last month compared with a year ago May. The American Petroleum Institute reported inventories were up 3 million barrels The IAE projected global demand would exceed supply by 100,000 barrels a day for the remainder of 2023 and by 200,000 barrels a day through 2024. Assuming they are correct, the US needs to move ahead faster on developing our non-oil energy sources.

On July 25th, the Conference Board reported its Consumer Confidence Index had risen from 110.1 in June to 117 in July. This was its highest reading since July 2021. The Index as to future expectations rose to 88.3 in July, well above the June 80 reading which was at the threshold in expecting a recession.

On July 27th CNN reported pending home sales rose in June by 0.3%, the first increase since February. The BEA reported the economy grew by 2.4% in the 2nd Quarter, the 4th quarter in a row of economic expansion. The report also stated consumer spending was up by 1.6% in the current quarter. Additionally, business investing in infrastructure rose by 56% in the quarter driven by President Biden’s $293 billion infrastructure bill for private investments. Further nonresidential business investing rose by 7.7% during the 2nd Quarter compared with a 0.6% rise in the 1st quarter.

On July 27th CNN reported gas prices hit an 8-month high in June at $3.71 a gallon. However, this compares with $5.02 a gallon in June 2022. But gas inventories are now at their lowest level since 2015.

Stepping back to July 25th, UPS announced it had reached a tentative deal with 340,000 unionized workers (Teamsters) averting which could have been a very calamitous strike. The agreement, if approved by workers, is for five years. It calls for full and part-time workers to receive raises of $2.75 per hour in 2023 and $7.50 more per hour over the length of the contract.

UPS ships an average of 24 million packages a day. This approximates to one-quarter of all US Parcel volume. The is equivalent to 6% of the US GDP. Member voting starts on August 3rd and concludes on August 22nd.

Not all package delivery did well as on July 31st. The 99-year old trucking company, Yellow Freight (Corp) shut down, laid off 30,000 employees. The Teamsters represents 22,000 of these employees. With the significant size of the Teamsters/UPS settlement, one might assume Yellow Freight could not afford to be so heavily unionized.

The problem however for Yellow Freight was instead its business model. Yellow was the 3rd largest LTL (less than truckload) shipper in the industry with the LTL design requiring it to have 300 separate terminals spread around the country to offload portions of shipments and pick up portions of other shipments. This is an expensive and inefficient transport model compared with full truckload deliveries.

The model forced trucking companies to merge beginning twenty years ago requiring the surviving companies to take on heavy volumes of debt. Yellow Freight has $1.5 billion of debt on its books at the present time.

With the pandemic slowing all supply chains, the Trump Administration provided $100 million to Yellow Freight in 2020. An interesting aside to this extension of dollars from the Federal Government was at the same time Yellow Freight was fined $6.85 million for defrauding the Government about the delivery of military shipments.

Not only has commercial shipping been impacted by the COVID-19 pandemic, but U.S. life has been impacted with an acceleration of the use of delivery services as an essential element of commerce. According to the National Restaurant Association, more than half of US adults say takeout and food delivery are essential to the way they live and ecommerce as a share of total retail sales has jumped from 13.6% in 2019 to 18% in 2020 and is rising further in the current environment. The Bureau of Labor Statistics projects an additional 182,000 jobs for delivery drivers by 2030.

The Federal Reserve

On July 26th, the Federal Reserve increased the Funds rate by 25 basis points, setting it at 5.25% to 5.50%. This is the 11th rate hike and moves the Funds rate to the highest level in 22 years. The Chairman stated a further increase at the next meeting is possible as the Fed seeks to slow the economy and weaken inflation. They appear focused on moving the Funds rate to above 5.6% by the end of 2023.

To me, an additional hike should be expected. Then I believe they should stop. I for one do not want Federal Reserve policy to become a discussion point, or further, a point of contention during the upcoming Presidential election period and we are getting very close to that period heating up even more than it current is.

Cryptocurrency

I feel little importance in this area has taken place during July to an extent I would like to let the sleeping dog lie and skip the topic this month.

My Economic Outlook

The following is a direct quote from my June Review, "Well, we have a Federal Debt Bill in place and the stock market has taken off in a rally, with that enormous risk avoided for a limited time, it is time Congress quickly take up the long-term funding requirements for Social Security and Medicare. I would suggest these issues need to be addressed before we fully enter the 2024 election cycle. Without concrete solutions the two programs will soon be approaching bankruptcy and likely become a political football between the two parties."

Of course, nothing happened in July in Congress. Fortunately, the economy is continuing to click along at a sound level and though I believe the Fed is making a mistake in continuing to raise rates with inflation ticking down at an okay level, I feel both fixed income and common stock returns will be decent over the next two months.

Addendum

It is after the closing date for the Review but on August 1st, Fitch Ratings downgraded the U.S. credit rating from AAA to AA+. Cited as reasons for the downgrade were a steady deterioration in the standards of governance, the need for a last-minute debt resolution, the high and growing government debt burden, and the January 6th insurrection.

The last time the US debt rating was in 2011 by S+P which reduced the rating to AA+, which S+P continues to employ for the US. The move down to AA+ by Fitch places US debt below both Germany and Switzerland.

Disclosure

Greenrock Research is a registered investment advisor.

The information provided herein is intended for financial professionals and represents the opinions of Greenrock Research management, and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance is not necessarily indicative of future returns and the value of investments and the income derived from them can go down as well as up.

Our views expressed herein are subject to change and should not be construed as a recommendation or offer to buy or sell any security or invest in any sector and are not designed or intended as basis or determination for making any investment decision for any security or sector.

There is no guarantee that the objectives stated herein will be achieved.

All factual information contained herein is derived from sources which Greenrock believes are reliable, but Greenrock cannot guarantee complete accuracy.

Any charts, graphics or formulas contained in this piece are only for the purpose of illustration.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited.

Share this

- November 2025 (1)

- October 2025 (1)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- May 2024 (2)

- April 2024 (2)

- March 2024 (1)

- February 2024 (1)

- January 2024 (2)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (3)

- June 2023 (4)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

.png?width=2167&height=417&name=Greenrock-Logo%20(1).png)