Share this

Fixed Income Market Review - May 2023

by Bob Southard on May 31, 2023

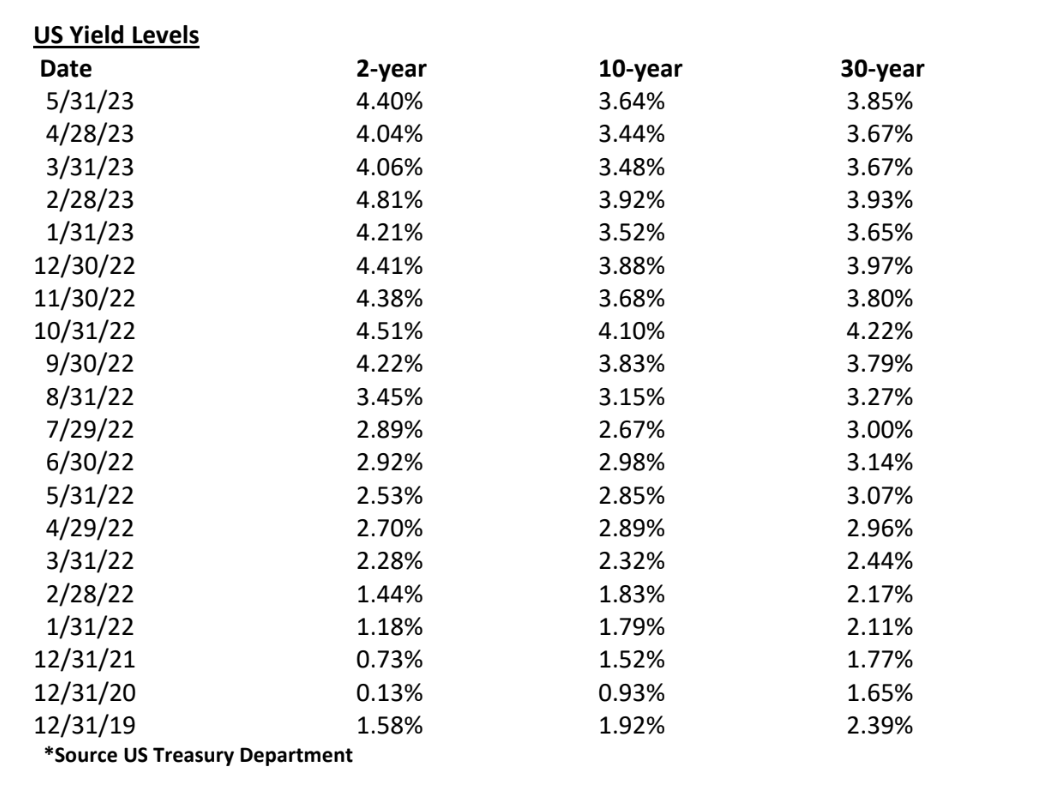

The threat of US default tied to the negative budget impasse risk led to a rise in interest rates, though the Fed's tightening cycle seemed to have been put on hold for a period. The magnitude of the curve flattening increased with the interest rate rise.

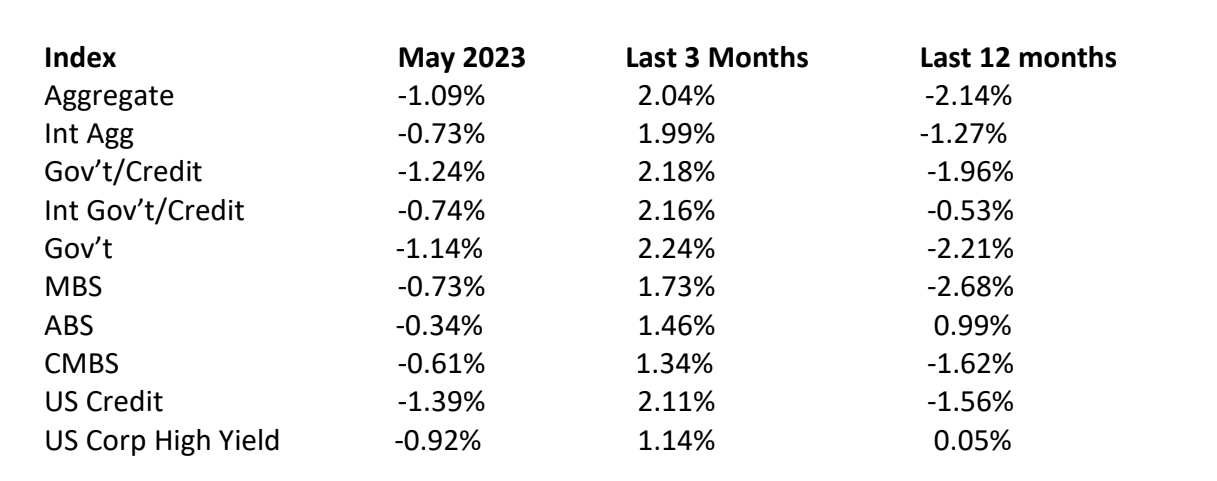

Bloomberg Barclay's Fixed Income Index Returns

Fixed income returns had been positive for March and April but the rise in interest rates with the risk of a US default was too high a hurdle to overcome. Monthly returns were again negative, though not to the degree one might normally expect, and not to turn the last three-month period negative.

May Economic News

As an interesting note to the recent bank collapses, the Fed reported that during 2022, bank deposits had already fallen on a year-over-year basis to be the first annual decline for deposits since 1948. Following up on the recent bank failures, in mid-April bank deposits dropped further by $76.2 billion. After the takeover of Silicon Valley Bank and Signature Bank, Americans pulled an additional $100 billion out of banks.

Among the three bank failures, was the collapse of SVB representative of a broad bank industry weakness? Examinations of SVB by American Action Forum showed a customer base that was extremely poorly diversified, focused primarily to health and tech startups in the Silicon Valley area. These entities were forced to pull their deposits from SVB to meet their rising liquidity needs in the rising interest rate period. SVB was internally invested in long maturity securities and not able to meet this run on its assets without incurring significant market losses.

Is the American public fearful of a continued bank industry collapse? Morning Consult found in a survey that before the bank collapses took place, 66% of banks were doing what was right, with this percentage of trust increasing to 70% after the collapses. Further only 10% withdrew their funds from banks even when Silvergate Capital was added to the bankruptcy list.

However, 65% of adults felt more banks would be put into receivership by the FDIC. Therefore, the public is concerned about the banking industry but is not moving to a run-on assets.

It is into June, but since I am late with this report having been on vacation, on June 9th it was announced UBS and the Swiss Government will perform an emergency takeover of Credit Suisse and share in losses that may result. I have understood for years that Credit Suisse has had financial and management problems, but this takeover is still surprising.

I say that especially since it is now public knowledge negotiations have been actively

progressing since March on the rescue. The arrangement is UBS will cover the first 5 billion francs of losses it may suffer in the sale of Credit Suisse assets, with the Swiss Government covering excess losses up to 9 billion Swiss Francs.

As a term of the agreement, Credit Suisse must guarantee to keep its headquarters in

Switzerland. Further terms of the deal are still being worked out as of the date of writing this report. However, all efforts are being made to be certain Swiss taxpayers do not pay for this deal.

The US inflation picture remains mixed though with signs of a cooling. The CPI had increased on a year-over-year basis by 6% in February, then by 5% in March, then by 4.9% in April. The April reading was the 10th straight month the year-over-year number decreased.

On May 10th the BLS reported grocery prices had declined for the last month by 0.2% and dairy was down for the month by 0.7%. West Texas oil was reported to have declined by 1.2% for the month to $73 a barrel.

As to the US employment picture, the DOL reported 253,000 jobs added during April. The unemployment rate was reported as having declined from 3.5% to 3.4%, regaining its 54-year low reading. The 253,000 jobs level was a drop-off from a 295,000 per month average for the previous three-month period.

The Commerce Department reported the economy grew during the 1st Quarter at a 1.1% annual rate. This increase compared with 3.2% annual growth in the 3rd Quarter and 2.6% annual growth in the 4th Quarter last year. Job openings were reported as remaining high at 9,590,000.

On May 3rd the Fed raised rates by 1⁄4% to its highest level in 16 years. At this point it was the 10th hike in rates, having started the hike period in March 2022. The current benchmark level has been moved to 5.1%. The Fed’s statement with this latest increase removed the statement “some additional” rate hikes may be necessary.

On June 2nd the DOL shocked everyone reporting a job increase for May of 339,000 though the unemployment rate rose from 3.4% to 3.7% as workers returned to the active labor force. The VIX number declined to 14.6, the first time it has closed below 15 since February 2020.

Combining this huge jobs number with the settlement the prior week of the debt ceiling, the question is prominent whether the Fed will make a further tightening step at its June 13-14th meeting. I personally believe the Fed will continue in a pause position but approximately 1/3 of US economists disagree with this opinion and expect the Fed to tighten.

The BLS reported wage growth slowed in May with average hourly earnings rising 4.3% on a year-over-year basis, up from a 4,4% increase through April. On a monthly basis, hourly wages grew by 11 cents, representing a 0.3% increase to $33.44 in April.

Prior monthly reports got stronger as March was revised up from 165,000 to 217,000 and April up from 253,000 to 294,000. With this trend, I expect the May 399,000 number will in the next month also be revised up. Backing up these strong employment reports, BLS reported the ratio of vacancies to unemployed stands at 1.8, well above the 1.0 to 1.2 level judged to be normal. As an interesting aside to these economic numbers, for the first time since 2007 the US Treasury Department auctioned $15 billion of one-day cash management bills to be issued on June 5th. The US Treasury Departments cash balance going into this auction was $37 billion, its lowest level since 2017. With the debt ceiling bill having been approved the Treasury Department will again be able to borrow money, a step it was not able to take with the debt ceiling being under pressure. This was a problem that got very little press but should have been more recognized.

As a final note of news during the month, according to the Center for Research in Security Prices, at the peak in 1996 there were more than 8,000 publicly listed companies trading on US Exchanges. At present, this number has dropped to approximately 3,700. It seems companies are increasingly staying private to remain out of the public eye as to regulatory oversight and disclosure requirements. As a result of this shift from public to private, the combination of Apple and Microsoft now represent 15% of the entire S&P 500.

Initial public offerings are now drying up. During 2022 the US IPO market fell by 94.8% to just $8 billion, a 32-year low. The result is there are now approximately five times as many private- backed companies in the US as publicly traded companies.

I suggest such trends are making individual stock picking increasingly more difficult each year into the future.

My Economic Outlook

Well, we have a Federal Debt Bill in place and the stock market has taken off in a rally. With that enormous risk avoided for a limited time, it is time Congress quickly take up the long-term funding requirements for Social Security and Medicare. I would suggest these issues need to be addressed before we fully enter the 2024 election cycle. Without concrete solutions the two programs will soon be approaching bankruptcy and likely become a political football between the two parties.

Disclosure

Greenrock Research is a registered investment advisor.

The information provided herein is intended for financial professionals and represents the opinions of Greenrock Research management, and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance is not necessarily indicative of future returns and the value of investments and the income derived from them can go down as well as up.

Our views expressed herein are subject to change and should not be construed as a recommendation or offer to buy or sell any security or invest in any sector and are not designed or intended as basis or determination for making any investment decision for any security or sector.

There is no guarantee that the objectives stated herein will be achieved.

All factual information contained herein is derived from sources which Greenrock believes are reliable, but Greenrock cannot guarantee complete accuracy.

Any charts, graphics or formulas contained in this piece are only for the purpose of illustration.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited.

Share this

- November 2025 (1)

- October 2025 (1)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- May 2024 (2)

- April 2024 (2)

- March 2024 (1)

- February 2024 (1)

- January 2024 (2)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (3)

- June 2023 (4)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

.png?width=2167&height=417&name=Greenrock-Logo%20(1).png)