Share this

Q1 2023 Quarterly Letter

by Kevin Malone on Mar 31, 2023

What Happened and where are we headed?

Well, that was not the year we wanted. For the full year 2022, indices were down as follows.

The Aggregate Bond Index was down 13%,

The S&P 500 was down 18%,

The Small Cap S&P 600 was down 16%,

EAFE was down 14%,

Emerging Markets were down 19%.

Clearly, traditional investing saw no place to hide.

In our Fourth Quarter 2021 letter, we warned of the overvalued nature of stocks, so we were not surprised by the performance. Stocks at the end of 2021 were more overvalued than they had ever been. Even today domestic stocks are in the most expensive decile if you compare price to sales ratios going back over 120 years. In fact, if you eliminate the bottom half of the years when price to sales were very inexpensive and only compare the top half of price to sales ratios over the last 120 years, the price to sales ratios of the S&P 500 today is still in the most expensive decile.

It is fascinating to look at returns at the end of long bull market runs. Over the three years ending 12-31-2021, the S&P 500 doubled in value while our dividend strategy was up slightly over 60%. After last year, our dividend strategy and the S&P 500 are even for the preceding four years, a great reminder of what a core equity strategy should do. High highs and low lows are not the goal. Consistency is the goal! Achieving client investment needs is the goal!

All but one of our managers were down as well, but only a fraction of what indices were down.

Dearborn domestic large cap was down 2.6%,

North Star domestic small cap was down 1.9%,

Janus Henderson International portfolio was down 9.7%,

3EDGE Conservative was down 2.9%,

3EDGE Total Return was down 4.6%,

Red Oak 2-Year note was up 6%.

So, to be clear, we hate to see declines of any kind. Those who invested in the 60/40 portfolio have 84 cent dollars today. In order for them to get back to even, they need to see a rise of 20%. Our portfolios are down 6% or 7% depending on whether you used 3EDGE Conservative or Total Return, but even better if you used Red Oak 6%. We need to be up approximately 7% to get to break even. This is good protection. Did we hope for better? Absolutely. The largest contributor to that negative performance was our international portfolio which was down 9.7%. This happened because of the devaluation of the Euro against the Dollar as our country has been raising rates to slow down our economy and not because the underlying European stocks have deteriorated. At some point when our Fed stops raising rates, we will see a rebound in our international portfolio based on a stronger Euro. There was a hint of this in Q4, but we think there will be more to come.

We have seen these types of overvalued markets before, and they are always followed by long periods of very low index returns. After the 1980s and 1990s bull markets, the S&P 500 compounded at -0.95% for the decade of the 2000s. Is that what we will see in this decade? Hard to answer but domestic stocks today are more overvalued than they were in 2000. During the decade of the 2000s our dividend portfolio compounded at 7.7%. It would not be surprising to us to see a similar relationship between the S&P 500 and our dividend strategy as we get to the end of this decade.

Research Affiliates forecasts future returns 10 years out on a variety of asset classes. These are their projections for returns of various asset classes 10 years from now.

U.S. Large Cap Stocks 1.8%

U.S. Small Cap Stocks 5.1%

The Aggregate Bond Index 0.9%

EAFE 7.7%

Emerging Markets 8.5%

If these numbers are even close to being correct, we are in for a long period of producing excess returns with our strategies. Our dividend portfolios will have high returns just from the growth of dividends. When you compare the decade of the 2000s when the S&P 500 compounded at -0.95 and our dividend portfolios compounded at 7.7%, the excess was mainly cash flow from the dividends. The same will be true of the next decade. That is the great thing about using growing dividend portfolios, cash flow produces a higher percentage of the total return.

So, where do stock markets go from here?

We think the succinct answer is not higher, at least in domestic portfolios. Domestic stocks are still overpriced. Now, overpriced stocks do not necessarily mean stocks will decline. There have been plenty of times in history when we had overpriced stocks, only to see them go higher. We are certainly mindful of that, but we do not think this is one of those times. There are certainly many institutional investors who believe that opinion is wrong, that we have had the correction and the future is bright for investors and will show above average returns prospectively. We think this group will provide their clients with poor returns and when we get closer to the bottom they will give up. History has shown us this tendency. The non-believers always give up hope near the bottom, and this is referred to as capitulation. Actually, we love this group because they provide us the opportunity to buy some investments at remarkably low prices. This has not happened yet and there is no assurance it will happen this time, but we are keeping our eyes open for this possibility.

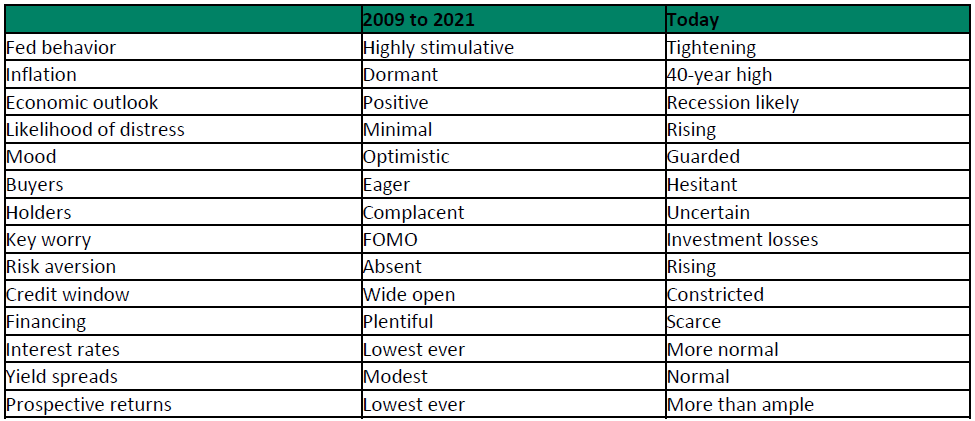

There are fundamental conditions in our economy and our world that drive us to urge caution. The best analysis we have read on this topic was written by Howard Marks in a letter to his investors. What Howard did was to list 14 items that can impact investment returns and compare where we are today on those issues with where we were in the 2009-2021 period of a straight up stock market. The chart below is what Howard used to illustrate his point that this should be a time of caution for all investors.

A year or two from now, we will see if Howard’s list is right. He does not need to be perfect in his current analysis in order to be right about urging caution. He expects minimal if any returns from stock prices over the next decade, and he is not alone. If you use Rob Arnott of Research Affiliates projection of domestic large cap equities annualized returns over the next ten years of.8%, $1 invested in the S&P 500 will be worth $1.19 at the end of 2031. How many clients’ investment return needs will be solved by that growth? Just remember there is history on these types of returns, recent history. $1 invested in the S&P 500 on January 1, 2000 was worth 95 cents ten years later. $1 invested in our dividend strategy on January 1, 2000 was worth $2.10 ten years later. This may not have solved the investment return needs of every client, but it solved the investment return needs of almost all clients. We think seven years from now at the end of 2029, we will be talking about another decade of very low returns from indices and very reasonable returns from dividend strategies.

Bonds are the same story but with two possible short-term outcomes. The 10-Year U.S. Treasury today yields 3.74% up from 1.77% at the beginning of 2022. The question for the bond market is will rates rise or fall from here? There are two camps in this discussion: those that think rates will rise and stay up as the economy expands and those who think we are headed back to low rates with the 10-Year U.S. Treasury yielding 2%. We think this is impossible to call; in addition, we do not think it will impact our investment decisions at least for the next two years. We do, however, have some thoughts about what happens depending on which camp you are in. The lower future rate group think the Fed will get inflation under control and future growth will be very low, thus the need to borrow will be low. This will mean the 10-Year U.S. Treasury could very well go to 2%. That will signal two things: future growth will be slow and the overvalued nature of stocks we discussed is even worse than we might imagine. This would project future returns from equities at very low returns, perhaps lower than the returns in the 2000s of -0.95%. If, however, the rising rate group is right, we will see all interest rates, short and long, rise and create losses for fixed income holders today. This very well may mean the economy expands, which is good for stocks, but not good for bond holders. They will have paper losses for a long time. History is important to remember when considering what to do. The total return of the 10-Year U.S. Treasury for the decades of the 1940s, 1950s and 1960s was 1.7%. Is this where we are headed? Impossible to answer, but important to remember history.

So, what do we recommend?

We have several thoughts, some about investments and others about how to keep your sanity in markets like we are about to witness.

- Do not be tempted to buy bonds.

Bond yields will not solve your clients’ investment return needs for a very long time, likely decades. Remember that the annualized return of the 10-Year U.S. Treasury for the 30 years of the 1940s, 1950s and the 1960s was 1.7%. If the 10-Year is headed for 2%, you will have gains from here, but then what will you do? The only answer will be our diversified ETF portfolios with similar volatility. You are better to make the change today if you have not already done so because if the rising rate group is right, our portfolios will achieve attractive returns while bond holders’ losses increase. - Be confident in getting growing income from dividend strategies.

We know it is conventional wisdom, to say you need bonds to reduce equity volatility even if the returns are too low to solve the investment return needs of your clients. This wisdom is just fundamentally wrong. Our domestic dividend strategy managed by Dearborn Partners reached the 10-year mark with us at the end of the 3rd quarter of 2022. The annualized growth of dividends for this portfolio over these 10 years was 10.3%. Will that be the same for the next 10 years? While we do not know, it will be reasonable, and the income is secure. - Substitute diversified ETF portfolios managed by firms like 3EDGE for bonds.

These portfolios have returns with a high correlation to the bond market and similar volatility to bonds. Last year, the Aggregate Bond Index was down 13% and the most these ETF portfolios have ever been down was 4%. These portfolios protect your principal, unlike bonds in the recent past and looking forward. The conservative portfolio was down 2.9% and the Total Return portfolio was down 4.6% last year. If bonds had achieved these returns last year, we would not be as concerned about the bond market. - Be patient as markets work out the excesses in the system.

Opportunities will present themselves. Whether they come in 2023 or 2024 we have no idea, but opportunities will be there. At the end of 1972, stocks were dramatically overpriced, as they are today, and it took over ten years to work out the excesses. We have no idea if this time the workout will take ten years, but it is likely markets will be working out excesses for some time to come. - Do not believe the imposters.

Markets will test our commitment to thoughtful strategies, they always do. During the Depression, there were three times when stock prices rose dramatically, 80% in round numbers. In 1938, the President and the Fed Chair declared the Depression was over and good times were upon us. The stock market fell over 30% and the Fed had to raise rates again. Wishing for a solution like they did is not a plan. We will have stock market rallies and declarations that the future is bright, and some day it will be true. Our strategies will solve your clients’ investment return needs whether we have great markets or terrible markets. That is what we need to keep in mind. - Include private investments in client portfolios.

Use private investments like the Red Oak 6% 2-year note or the Red Oak 4-year portfolio with an expected return of 15% to complement your liquid holdings. - Stay open for new ideas.

Markets like the one we are in present unusually low-priced opportunities, and we need to be vigilant but patient and are constantly talking to firms about new ideas. We never know when they will arise, we just want to open to all new ideas.

As we close our year-end letter in what has been a trying year on many fronts, we wish everyone a happy, healthy and prosperous 2023.

Disclosure

Greenrock Research is a registered investment advisor.

The information provided herein is intended for financial professionals and represents the opinions of Greenrock Research management, and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance is not necessarily indicative of future returns and the value of investments and the income derived from them can go down as well as up.

Our views expressed herein are subject to change and should not be construed as a recommendation or offer to buy or sell any security or invest in any sector and are not designed or intended as basis or determination for making any investment decision for any security or sector.

There is no guarantee that the objectives stated herein will be achieved.

All factual information contained herein is derived from sources which Greenrock believes are reliable, but Greenrock cannot guarantee complete accuracy.

Any charts, graphics or formulas contained in this piece are only for the purpose of illustration.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited.

Share this

- January 2026 (1)

- October 2025 (1)

- July 2025 (1)

- April 2025 (1)

- January 2025 (1)

- October 2024 (1)

- July 2024 (1)

- April 2024 (1)

- January 2024 (1)

- October 2023 (1)

- August 2023 (1)

- March 2023 (2)

- December 2022 (1)

- September 2022 (1)

- June 2022 (1)

- March 2022 (1)

- December 2021 (1)

- September 2021 (1)

- June 2021 (1)

- March 2021 (1)

- December 2020 (1)

- September 2020 (1)

- June 2020 (1)

- March 2020 (1)

- December 2019 (1)

- September 2019 (1)

- June 2019 (1)

- March 2019 (1)

- December 2018 (1)

- September 2018 (1)

- June 2018 (1)

- March 2018 (1)

- December 2017 (1)

- September 2017 (1)

- June 2017 (1)

- March 2017 (1)

.png?width=2167&height=417&name=Greenrock-Logo%20(1).png)