Share this

Q2 2018 Quarterly Letter

by Kevin Malone on Jun 30, 2018

Volatility and Future GDP

We all love certainty. When we make a decision, we feel best if we have high conviction, certainty. We make hundreds of decisions every week, what route to drive to work, what to eat for lunch, what charts to prepare for a client review. Some of our decisions are meaningful and potentially life changing, while others have very little consequences. If we took the wrong route to work, we might be 10 minutes late; but if we choose the wrong investment solutions, that can have dire consequences on our future.

When we invest in the stock market, volatility creates the lack of certainty. We do not like that. If we buy a stock or use an investment thesis, we get immediate feedback. We can look at our gain or our loss the next day, the next week, and it is reassuring when we have a gain. That is human nature. This is why many investors liked 2017 because there was little volatility, high apparent certainty. It was an anomalous year, every month closed higher than the previous month and the biggest intra‐month decline was 3%. This carried into January as the stock market indices continued to rise, and then we got February. From the high the market dropped 6% in just a few trading sessions, something we had not seen in a while. For many investors, their anxiety rose dramatically because of the uncertainty this created. The certainty of our investments that we saw in 2017 and January disappeared, seemingly overnight.

Let’s put 2017 into perspective. There is a measure of risk called the Sharpe ratio; it was developed by Dr. William Sharpe, Professor Emeritus at the Stanford University Graduate School of Business. The Sharpe ratio is a measure of risk adjusted performance. The formula is calculated by subtracting the risk‐ free return from the stock market return and dividing that number by the standard deviation. The idea is to compare various asset classes not by return but by how much risk was taken to get the return. If you used round numbers, the longterm return of the S&P 500 is 10%, a risk‐free rate is 5% and then divide the difference of 5% by a standard deviation of 15%, you would have a Sharpe ratio of .33. In 2017 the Sharpe ratio of the S&P 500 was 4, not usually high, stratospherically high. So, for those investors who liked 2017 and got comfortable with 2017 and January of this year, they did so without the benefit of an historical perspective. That could not continue and will not continue.

So, does this mean we are supposed to like volatility? Well, the answer is yes if it refers to monthly, annually or even rolling 3‐year periods, and many investors will not like that answer. Stock markets go up or down based on investors following ideas. Momentum investors buy what is going up, while value investors buy off the new low list. If you are a momentum investor, February was not kind to you financially or psychologically. If you are a value investor, you may have been hurt financially but psychologically you are relieved that stocks do not just go straight up.

What is the Future Like?

The short answer is it will not be like 2017. The Sharpe ratio in the future will be much closer to .33 than 4. It would not be outrageous to say we will never see a Sharpe ration of 4 again in our lifetimes. We have no way of knowing what Sharpe ratios will be in the future, but as you are aware we believe long‐term future returns are related to sound investing principles not anomalous years that provide a false sense of calm. So, our first piece of advice is do not expect to see another 2017 anytime soon, if ever.

We think the future is directly related to GDP. Now, there is a great debate in the works on future GDP growth rates. Our President has said that we will achieve 4% GDP, perhaps higher. His supporters continue to say that anyone who does not believe this is somehow anti American. Many economists are skeptical. GDP growth over the last five years has been 2.25%, and many economists are suggesting we may get to 2.5%. The next five years investment returns will be dependent on who is right; 4% GDP growth will bring good times and higher prices; 2.5% GDP growth will bring high volatility and lower returns. So, let’s look at the factors that might determine what camp might be right.

The following is a list of factors we look at to determine where we might be headed: Fed policy, inflation and the level of interest rates, strengthening or weakening dollar. In addition, we will look at valuation levels to see where we might get return.

The Fed has stated their policy. They plan to have three more rate hikes for the remainder of this year and three or four next year. In addition, they will reduce their portfolio of fixed income securities. The fed did all of this in 1937. The Fed then lowered rates in 1929 in reaction to the depression just as they did in response to the recession of 2008. By 1936 the Fed thought our economy was stable and raised rates in 1937. Luckily for us, our current Fed can look at the mistakes made in 1937 when the stock market fell by 37%. They will need to be very careful; lowering rates creates an immediate solution for the economy while raising rates is like playing with fire. So, it appears rates are going up, and that is generally not good for our economy.

Inflation is a two‐edged sword. It will help us with our debt over the long‐term, but it can be very hard to control. If we had 2% inflation over the next 36 years, our current debt would look like it was half of what we see today. That is assuming we do not increase our debt, which we are currently doing. So, over the long‐term inflation helps us. The Fed has been trying to get an inflation target of 2% but has been unable to do so with consistency. So, this also suggests that rates will be higher.

Economies with strengthening currencies provide attractive investment returns while economies with weakening currencies often are not as attractive for investors. For the last 16 months the Euro, the Pound and the Yen have all been strengthening against the dollar. Now this may or may not be a trend; however, historically, these cycles run for 7 years not just one or two years. This would not be taking place if our GDP growth rates were high, so this would suggest caution regarding our future GDP growth rates.

Now all of this can change, and economists point to some factors that may boost GDP. The tax cuts are the most common issue mentioned. There is debate on both the corporate tax cuts as well as the personal tax cuts as to how much additional GDP growth these would add. While the verdict will need time to be rendered, it does not appear to us that the impact will change much.

So, our estimate of future GDP growth is in the 2% area. It will vary year to year as it has in the past, but we think it is highly unlikely to get past 3% annually over the next 5 years and 4% is a fantasy. So, we believe that the volatility we have seen is a look into our future. Low growth and volatility is not anyone’s dream economic environment, but our dividend strategies will perform very well in that environment.

One word of caution on the indexes. The S&P 500 is currently weighted 24.9% in Tech and 14.7% in Finance. We are all aware of the FAANG stocks and the negative press they are currently getting. The S&P 500 is now a very concentrated index, just like it was in 1999. There was a shift away from growth toward value in 20002002, and we would caution index investors to be aware we could experience a similar phenomenon in the next few years. This would be great for our dividend strategies, but not good for index investors.

Alternative Investments

You have heard us say, likely many times, that all your clients need a 3EDGE account. We believe this for two reasons.

- You will not be able to achieve your clients’ investment return goals by allocating to fixed income. The returns of the 10‐Year U.S. Treasury during the 1940s, 1950s and 1960s were 2.5%, 0.8% and 2.4% respectively. This was the last time rates were as low as they are today, and the annualized return for the 30 years of the 1940s, 1950s and 1960s was 1.87%. Now you can add something to that to get the corporate bond return, let’s say 1% realistically and that might approximate the return of the Barclay’s Aggregate Bond Index. BlackRock has suggested the annualized return of investment grade bonds over the next decade will be 2.5% and 1.5% for High Yield. Whatever these returns turn out to be, they will be so low you will not achieve the needed returns your clients will require by investing in bonds. Our answer to this dilemma is 3EDGE.

- You need a risk on/risk off portfolio now and you will need one as the next decade unfolds. Projected returns from equities and from fixed income over the next decade will most likely be much lower than historical returns. BlackRock’s returns for fixed income are listed above, and they believe the equity returns over the next decade will be 5%. We have all seen similar returns expectations form other sources as well. We have had a stock market that has been rising for nine years, now the second longest rise in history. Our models use a dividend strategy for equities, but our models also use 3EDGE as an integral part of all allocations.

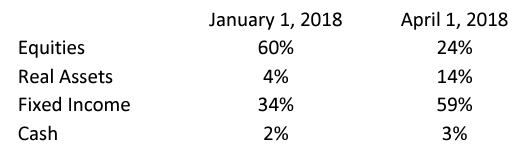

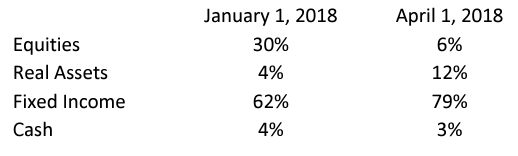

So, with that as a back drop, we thought you would want to see how the 3EDGE portfolios are currently weighted and how that compares with their allocation at the beginning of the year. The charts below tell the story.

3EDGE Total Return Portfolio Allocations

3EDGE Conservative Portfolio Allocations

As you can see 3EDGE has gone from fully risk on at the beginning of the year to fully risk off today. This decline in risk started in February. The last time these portfolios were in risk‐off mode was in early 2008, and all of our clients were happy they had allocations to these strategies.

Now it is anyone’s guess as to how this year and next year unfolds. Have we seen the high for equities or will we revert to a rising market later this year? No one has a crystal ball. We simply structure portfolios in an attempt to get reasonable returns in all markets, the crazy up markets like 2017 and the crazy down years that will inevitably be part of our future. Do we know the move by 3EDGE will be right? Of course not! But we are thrilled we have them as part of our overall allocations.

Specialty Investments

We have four portfolios which fall into our Specialty category that may be appropriate for various types of clients. Just as a reminder, our definition of Specialty Investments is temporarily undervalued investment with the definition of temporary being years. We will have reports on each of these to you later in this quarter, but we wanted to highlight them in this letter.

India

Nominal GDP growth in India is projected at 11% while inflation should be 4%‐5%. The population of India looks like near perfect demographics with an average age of 25. It is an English‐speaking democracy. Price Waterhouse Coopers, UK issued a paper titled “The World in 2050”. This paper suggests India will experience 7%‐8% GDP growth from 2015‐2050. This is why we think a specific investment in India will be the right idea for a portion of some of client’s assets. We will use a fund managed by Kotak Mahindra, a Mumbai based investment management firm.

Micro‐cap

Deep Value This is an asset class that historically had both higher returns and lower volatility than developed countries. The manager of the strategy is a San Diego based firm called Metis, which is a joint venture between Michel Allen and Brandes Investment Partners. Michel is a former partner at Brandes. The portfolio is broadly diversified across companies with market values of $50‐$500 million and currently has a 3% dividend yield. One will need to think of this portfolio as a long‐term hold, but value has underperformed dramatically and the potential of a shift toward value is the reason for owning it.

MLP/Yield Co

MAI manages a 10 stock MLP/YieldCo portfolio for us. The portfolio has a current yield of 6% with expected dividend growth of over 10%. Dividend growth in in 2016 was 14% and last year was 13%. The main reason to own the portfolio is dividend growth. These stocks have not performed well in 2017 and we think offer an interesting entry point opportunity even of the price of oil declines.

Cell Tower/Billboard Lease Portfolio

The Landmark Dividend fund is a private fund that offers no liquidity and has a three to five‐year life. The current yield is approximately 7%. It invests in 300‐400 leases of call towers and billboards near airports in major metropolitan cities. The structure of the investment gives the limited partners a 10% annualized return at sale before the general partner participates in the total return.

Portfolio Construction

These are the tools and the strategies we recommend in developing portfolios. We think the biggest problem advisors face is you will not have fixed income in the traditional sense to provide income and stability to portfolios. We have no idea how long that will last, and we will welcome traditional fixed income back into our portfolios when rates rise to a level that will allow you to solve for your clients’ investment return needs. But that is a long way off in the future. The income from our equity strategies and from the MAI MLP/Yield CO portfolio as well as Landmark will be the safe but volatile places to get income. The income is safe and growing, but the underlying volatility will be difficult for some clients to stomach. That is the art of asset allocation which you practice every day.

Disclosure

Greenrock Research is a registered investment advisor.

The information provided herein is intended for financial professionals and represents the opinions of Greenrock Research Management, and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance is not necessarily indicative of future returns and the value of investments and the income derived from them can go down as well as up.

Our views expressed herein are subject to change and should not be construed as a recommendation or offer to buy or sell any security or invest in any sector, and are not designed or intended as basis or determination for making any investment decision for any security or sector.

There is no guarantee that the objectives stated herein will be achieved.

All factual information contained herein is derived from sources which Greenrock believes are reliable, but Greenrock cannot guarantee complete accuracy.

Any charts, graphics or formulas contained in this piece are only for the purpose of illustration.

Unless otherwise indicated, S&P 500 historical price/earnings data herein is from www.standardandpoors.com, SP500EPSEST.xls. S&P 500 and S&P Top 100 by dividend yield historical return data provided by Siegel, Jeremy, Future for Investors (2005), With Updates to 2014. S&P 500 total returns since 1970 are supplied by Standard & Poor’s. S&P 500 data prior to 1970 is Large Company Stock data series from Morningstar’s Ibbotson SBBI 2009 Classic Yearbook. Each stock in S&P 500 is ranked from highest to lowest by dividend yield on December 31st of every year and placed into “quintiles,” baskets of 100 stocks in each basket. The stocks in the quintiles are weighted by their market capitalization. The dividend yield is defined as each stock’s annual dividends per share divided by its stock price as of December 31st of that year. References to “returns” refer to the total rates of return compounded annually for periods greater than one year, with dividends reinvested on the S&P as a whole, or on the Model, as applicable, for the period of time (years) indicated. As such, “returns” are a measure of gross market performance, not the performance of any client’s investment portfolio (which would ordinarily be subject to management fees and, possibly, custodian fees and other expenses). Index data is supplied by Morningstar Direct.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited.

Share this

- January 2026 (1)

- October 2025 (1)

- July 2025 (1)

- April 2025 (1)

- January 2025 (1)

- October 2024 (1)

- July 2024 (1)

- April 2024 (1)

- January 2024 (1)

- October 2023 (1)

- August 2023 (1)

- March 2023 (2)

- December 2022 (1)

- September 2022 (1)

- June 2022 (1)

- March 2022 (1)

- December 2021 (1)

- September 2021 (1)

- June 2021 (1)

- March 2021 (1)

- December 2020 (1)

- September 2020 (1)

- June 2020 (1)

- March 2020 (1)

- December 2019 (1)

- September 2019 (1)

- June 2019 (1)

- March 2019 (1)

- December 2018 (1)

- September 2018 (1)

- June 2018 (1)

- March 2018 (1)

- December 2017 (1)

- September 2017 (1)

- June 2017 (1)

- March 2017 (1)

.png?width=2167&height=417&name=Greenrock-Logo%20(1).png)