Share this

Q3 2021 Quarterly Letter

by Kevin Malone on Sep 30, 2021

2021 and Beyond

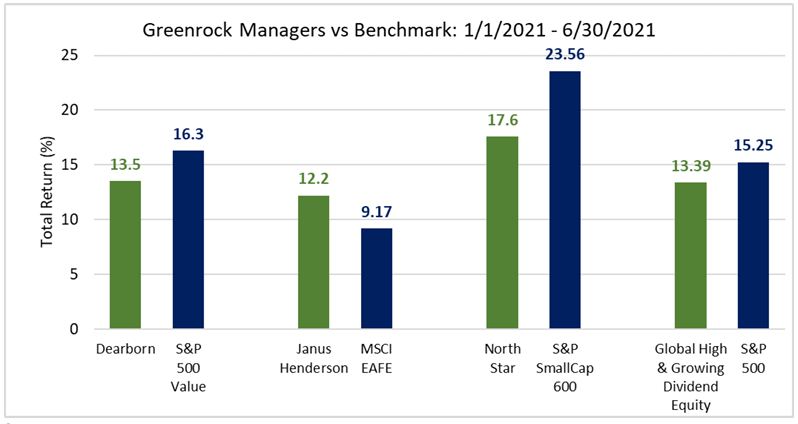

What we have experienced in our equity portfolios thus far this year is welcome, consistent with our messaging and will be with us for a long time. Our Global High & Growing Dividend Equity Strategy is up 13.39% for the first six months while the S&P 500 is up 15.25% and EAFE is up 9.17%. The shift away from growth and toward value is alive and well and will continue for some time, by that we mean years. For the first six months domestic value is up 16.3% while domestic growth is up 14.3%. Chart 1 shows the specifics of our equity managers against their respective indices.

Chart 1 Source: Morningstar Direct

Source: Morningstar Direct

These returns are in contrast to the index returns against our returns for last year when the S&P 500 rose 18% while our portfolios rose only 5%. As you likely recall, our analysis of the S&P 500 last year showed six stocks, Microsoft, Apple, Amazon, Google, Facebook, and Netflix, were up 14% in absolute terms as weighted in the index while the S&P 494 was up 4%. This was a phenomenon we have not seen since 1998 and 1999 when twelve stocks and then six stocks produced more than the entire return of the index for each year. You may recall that the following three years of 2000, 2001 and 2002 were not kind to index investors as the S&P 500 declined 37% while our dividend strategies rose 15%.

So, the ever-important question is what will happen over the next three years? What we know with certainty is it will not be an exact repeat of 2000-2002, so let’s get into what we see.

Positive GDP

The headline GDP story for this calendar year is GDP will be high, perhaps 6% or even 7%. While this would be a remarkable story, changing our view of future returns from assets if we thought it was the beginning of a trend, we do not see that. What we see is a make-up from last year followed by a continuation of slow growth. Last year GDP by quarter was as follows, Q1: 0.3%, Q2: -9.0%, Q3: 2.9%, Q4: 2.4%, and GDP was -3.5% for the year. Today our economy and our lives are opening up, and we will all likely in the coming months spend a little of the money that we saved while the economy was closed most of last year. We can go to restaurants, travel, and generally enjoy life beyond work in normal ways again, unlike our reality of last year. Today restaurants and movie theaters are open and full, a very good sign. As major league baseball parks have opened to full capacity, people are flocking to see their teams play. So, the optimism of high GDP growth this year is warranted, but our question relates to follow through. What will GDP be in 2022, 2023 and beyond? We think there are two factors to consider, government policy and the age of our population.

Government

You may have noticed we almost never talk about politics in these reports. This is not because we have no opinions, we speculate about elections and government policy just like most of us do. We do not express opinions because we do not think we are qualified to do so. Like all of us, our opinions are influenced by our analysis as well as by our prejudice, and the latter has no place in investment opinions. We like a perspective on history, data and good economic facts to express opinions. So why are we making an exception? Our answer comes from two sources, our view of our economy and our observation of what politicians are saying today. So, let’s start with the data.

The Fed has been attempting to get inflation above 2% for a simple reason, we have too much debt. In simple terms, 2% inflation over 36 years makes the value of the dollar half of today’s value. So, while the dollar amount is constant, the value of those dollars has declined making payback cheaper.

This would be very wise logic if it were coupled with a balanced budget and the expectation of balanced budgets in the future. When was the last time you heard a politician suggest we should have a balanced budget? Do you remember Barry Goldwater? So, perhaps a little cynical as there have been balanced budget proponents since Barry’s time, but serious debate on balancing the budget or reducing debt has been nonexistent in our political discourse for the last 20 years. Whether you are Republican or a Democrat, just look at the times in the last 20 years when your party held the presidency and ask yourself what was our debt at the beginning of those years and what did it grow to at the end of those years?

So, what we see is no political will to rein in spending or debt.

The age of our population

The second factor is we have an aging population. Two things happen when people age, they spend less, and they need medical and government services more than at any time in their lives. Baby boomers caused the 1980s and 1990s to be fabulous times of real growth. As that group had children, bought and furnished homes and lived their lives, the economy grew dramatically. The first group of baby boomers will turn 75 this year while the youngest group will be 57. The older groups are in the heart of their later years and the younger groups are planning for it.

History

So, what does history tell us about economies that have high levels of debt, a political system that has no answers to deal with that debt and a population that is aging? It tells us to expect slow growth. Japan’s equity markets at one point about 50 years ago was 70% of the EAFE index. Since that time, it has stagnated. Now I know many of you will find it audacious for us to mention Japan, so let’s be clear. We are not saying we will be a repeat of Japan. We have been a society that has faced reality in ways Japan did not, allowing bankruptcy is just one example of that. But we think these factors, our debt and the age of our population, are what give us pause on future growth.

So, what do we see?

We think GDP growth will peak in Q4 or early next year and retreat back to sub 2% levels. We think we will continue to borrow to fund our deficits. In addition, we think our political system will continue to lack the courage or the creativity to deal with these issues. You can observe this by watching interest rates, they are very likely to decline over the next six months.

Well, that is depressing, do you see any bright sides to our future?

Actually, we do see a transformative side to our future: technology. We have recommended the book The Future is Faster Than You Think by Peter Diamandis since it came out in January of last year. Peter lays out the dramatic technological changes that are taking place today, and he builds the argument that these changes will continue for at least the next decade. Self-driving cars and blankets we use at night that will detect illnesses in our body are just two of the many changes he points out that will alter our lives dramatically. He makes the case we will live longer and healthier than we do today and perhaps than we can imagine.

How to invest in this climate?

We have been saying there are two principles that need to drive our portfolios: cash flow investments and an allocation to the future. We think the general stock market might resemble the decade of the 1970s. The compounded return of the S&P 500 during the 1970s was 5.4%, well below the long-term return of 10%. Interestingly, Jeremy Siegel reworked the S&P 500 historically weighting stocks by contributions to the dividends of the index. Using his methodology, the returns during the 1970s were of over 10%. Might this decade of the 2020s see similar contrast between index returns and dividend returns? We think so. We think the cash flow from dividends will be a large contributor to total return. If we take the current dividend yield of our dividend portfolio, 3.25%, and grow it at 6% per year for a decade, the final dividend yield is 5.83% assuming stock prices remain static. What we know is stocks will fluctuate. But if we are right on slow growth and slow inflation, a 5.83% dividend yield is very unlikely to exist, investors will bid up the stock prices. So rather than a total return of just the dividend, investors will get appreciation in addition to the yield. How much appreciation? We have no idea, but it would not take much to get the total return of our dividend portfolio to be similar to the returns of the last decade, 9.3%. We think the important question is will 9.3% solve the investment return needs of your clients? We think likely most of them.

What about Inflation?

We do not know for certain today if inflation is coming, but there are some signs we should take seriously. We are putting money in the hands of those who are out of work. In addition, there is a new federal program that gives workers money even if they are employed. While this is not by itself a catalyst, it could bring inflation if we get a catalyst. All we need is the perception of inflation for people to start spending, which would cause inflation. Might this happen? While we do not know with certainty, preparing portfolios for a potentially inflationary environment is prudent. Also, knowing what equity strategies lead the market in inflationary times is important. You guessed it, growing dividend strategies is the right choice.

We have four principles that should dominate portfolios as we look out the next several years, and they are as follows:

- Value will outperform growth, and we like our dividend portfolios to do so.

- Bonds should not be a part of your portfolios; yields are simply too low.

- Cash flow should be a large part of your investment thesis. We think the dividends in equities and the cash flow from private investments will be critical in the coming years just as it has been for the first six months.

- Everyone needs an allocation to disruptive technology stocks. They will be volatile but will be the stocks of the future.

Disclosure

Greenrock Research is a registered investment advisor.

The information provided herein is intended for financial professionals and represents the opinions of Greenrock Research management, and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance is not necessarily indicative of future returns and the value of investments and the income derived from them can go down as well as up.

Our views expressed herein are subject to change and should not be construed as a recommendation or offer to buy or sell any security or invest in any sector and are not designed or intended as basis or determination for making any investment decision for any security or sector.

There is no guarantee that the objectives stated herein will be achieved.

All factual information contained herein is derived from sources which Greenrock believes are reliable, but Greenrock cannot guarantee complete accuracy.

Any charts, graphics or formulas contained in this piece are only for the purpose of illustration.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited.

Share this

- January 2026 (1)

- October 2025 (1)

- July 2025 (1)

- April 2025 (1)

- January 2025 (1)

- October 2024 (1)

- July 2024 (1)

- April 2024 (1)

- January 2024 (1)

- October 2023 (1)

- August 2023 (1)

- March 2023 (2)

- December 2022 (1)

- September 2022 (1)

- June 2022 (1)

- March 2022 (1)

- December 2021 (1)

- September 2021 (1)

- June 2021 (1)

- March 2021 (1)

- December 2020 (1)

- September 2020 (1)

- June 2020 (1)

- March 2020 (1)

- December 2019 (1)

- September 2019 (1)

- June 2019 (1)

- March 2019 (1)

- December 2018 (1)

- September 2018 (1)

- June 2018 (1)

- March 2018 (1)

- December 2017 (1)

- September 2017 (1)

- June 2017 (1)

- March 2017 (1)

.png?width=2167&height=417&name=Greenrock-Logo%20(1).png)