Share this

Q3 2025 Quarterly Letter

by Kevin Malone on Oct 23, 2025

So, This is a Good Year

After having risen almost 11% in Q2, the S&P 500 is up 8.12% in Q3. The growth side of the value/growth equation is driving these returns. For the last 9 months, growth has gone up 19.53% while value is up only 9.68%. So, everything must be just fine, right? Well, a lot of things are fine, but valuations are far from fine - they are overpriced dramatically

At year-end 2024, the S&P 500 was more highly priced than at any point in history. The price-to-sales ratio of the S&P 500 was over 3. This was the first time the price-to-sales ratio had ever hit 3 times sales. It did not do so in 1929 at the peak of stock prices during the depression, nor did it reach this high at the end of the first quarter of 2000, the peak of the market for the 1982-Q1, 2000 great bull market. We all remember what happened after 1929, and the decade of the 2000s saw the S&P 500 compound at -0.10% for the entire decade. $100 invested in the S&P 500 at the beginning of 2000 was worth $90 at the end of the decade. During this decade, our dividend strategy compounded at 8.2%.

If you look at the price/sales ratio of the domestic stock market today, it is over 3 times. Now while this was also true at the beginning of this year, it is notable when it was not true. The domestic stock market traded lower than 3 times sales at the peak of the market in March of 2000 as well as at the peak of the market in 1929. You will remember both of those periods were followed by dramatic, devastating declines of stock prices. From April 1, 2000 to September 30, 2002 the stock market fell 42%, and in the Great Depression stocks fell over 80% from their peak.

So, is that what we are expecting? The direct answer is no one can thoughtfully answer that question. What we can answer is the question of overvaluation of the stock market, and today’s valuation suggests caution.

What is Diving the Overvaluation?

The answer is easy, AI. Artificial Intelligence is going to change our world, and it will do so quickly and dramatically. This is the mantra of the AI bulls, and it better be true because the valuation of the largest stocks in our country are priced as though this is happening.

This reminds us of the mantra of stocks at the end of 1999. The drivers then were the internet and the cell phone, and they did change our world. The problem was, just like today, they had come through a period that had their stocks achieving almost all of the return of the S&P 500 over the 1998-1999 period. What followed was unpleasant at best for investors in these companies. It was 6 stocks then, and they all declined in 2000. The first one to come back to even took over 9 years. You might remember the return of the S&P 500 during the decade of the 2000s was negative, $100 invested in the S&P 500 at the beginning of the decade was worth $90 at the end of the decade.

So, is that what we are in for this time? Well, no one knows the answer to that question, but we do have some significant caution on the euphoria of what these AI stocks can do. We have two sources of caution.

First, the Science

Rodney Brooks is a roboticist at MIT where he has been for 30 years. He is also the co-founder of Roomba which is a firm that has portable vacuum cleaners and portable mops for the home. These tools allow you to clean your house while you are not home. He is also the founder of iRobot. He recently issued a very cautious sentiment on robots. He said the following: “Today’s humanoid robots will not learn how to be dexterous despite the hundreds of millions of dollars being invested by the VC firms and major tech firms to pay for their training.” He went on to explain that the sensation of touch is one of the most complex systems in the human body. The human hand has 17,000 low threshold mechanical receptors for picking up items, which become denser toward the end of the fingertips. The receptors in your hands respond to a myriad of stimuli like pressure-vibrators in sync with 15 different families of neurons. All of this adds up to a complex mechanism that humans want to replicate in robots. While AI has been trained on large amounts of speech recognition, we do not have such a tradition for touch data. Brooks thinks in 15 years successful robots will look nothing like humans. He thinks they will have multiple wheels and arms and possibly hands. He thinks a lot of money invested in human robots will be lost and forgotten.

Now we have no opinion if Rodney is correct, but we do think with the success he has shown in his career we should understand his perspective. If he is right, the AI stocks are not overpriced, they are dramatically overpriced.

Second, Valuation

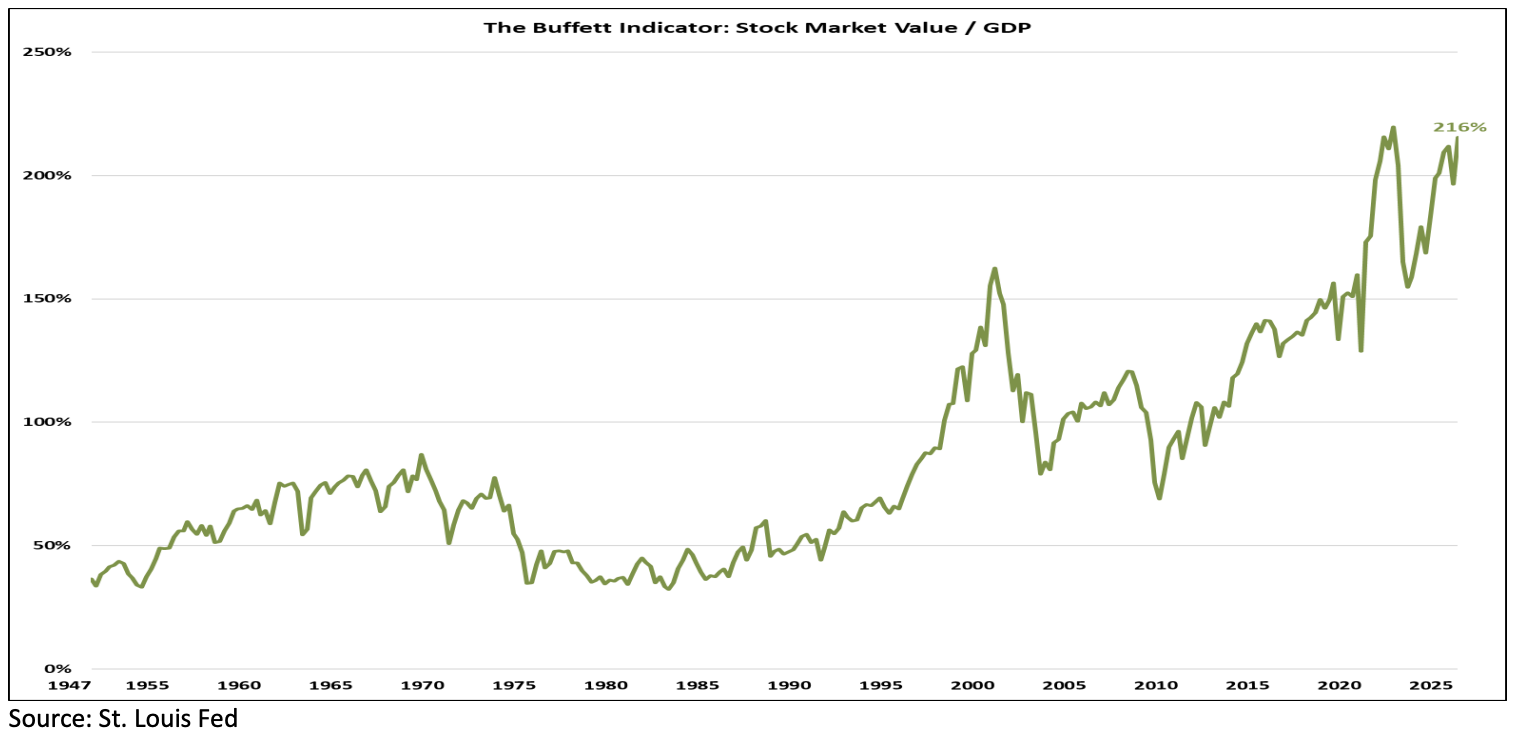

Warren Buffett is a person we have followed since starting this firm. He has a very disciplined investment thesis, and we have all read about his success. He developed an indicator for measuring the overvaluation/undervaluation of the stock market, and it is referred to as the Buffett Indicator. The formula divides the value of the domestic stock market by the annual GDP of this country. As of June 30, the total value of the stock market was $65.47 Trillion and our annual GDP was $30.15 Trillion. Doing the math shows the Buffett Indicator to be 217%. The chart below shows the history.

CHART 1

The chart above shows very high valuation of stock prices we are currently experiencing. Today the portfolio Warren manages has a higher percentage of cash as he has ever had because his indicator is very bearish. Now could his indicator go to 225% or even 250%? Sure, anything is possible. In addition, the people bullish on AI will tell you this will happen! We just worry about the risk. The history of growth outperforming value as it is today, is that investors who stick with their overpriced stocks have a very unhappy ending.

International Portfolio

Janus Henderson has managed our growing dividend international portfolio for 10.75 years. During this period, they have achieved a return of 133% while EAFE has returned 119%. This year our international portfolio is up 28.1% while EAFE is up 25.7%. By any measure this is fabulous performance both for our portfolio and for the index. In fact, we are more worried about the portfolio declining from here in the 4th quarter rather than achieving even more return. Now just to be clear this is a fear not reality, we do not project any returns over short periods. The yield on our portfolio started the year at 3.8% and is 2.8% today. While we like higher yields, we use this strategy for total return and yield is just part of total return. So, what this is telling us is that international stocks are not cheap anymore. History shows us that when yields get to 4% buyers come out of the woodwork. We will have to see what happens this time.

Bonds

As you know we eliminated bonds from our portfolios 6 years ago. This allowed us to avoid the worst return in bonds over a year in many decades. Now this year is a different story for the bond market. The 10 Year is up 7.01% and the US Aggregate Bond index is up 6.13% for the first 9 months of this year. While these are good returns the 3EDGE Conservative portfolio is up 11.65%. So, what do we think about returns from here? We think it is possible that rates could decline from here and the returns from bonds will continue to be attractive and will solve the investment return needs of clients. The difficulty we see is the timing. Rates will decline until they do not, and then bond investors will need to run for the hills. This timing dilemma is one we have no confidence we could maneuver correctly. In addition, the history of changes in the direction of bond rates happen very quickly and sometimes violently. Now, we would also say we have no idea how this time will play out. So, we will rely on the 3EDGE Conservative portfolio to maneuver us through this period. We do not envision ourselves recommending bonds as a viable investment for a very long time.

Odd Times

If our returns are more than reasonable for the first 9 months of this year, why are we so worried? The simple answer is valuations both in domestic stocks and bonds are very high. Couple that with the euphoria that AI will change our world, and the reality is we live in an era of change. Now while we think change is good, it also comes with uncertainty. If the bulls on AI are right stocks will rise but unemployment may decline because of the rise in AI. Amazon is building warehouses where the lights are off during the day because robots do not need lights, and robots are filling the orders. Amazon now uses more robots than people in their workforce. All of that seems like a positive development for the earnings of Amazon, but what impact does it have on employment. We have all read about the lack of jobs for recent college grads, and we wonder if that will be a trend or an anomaly.

The bottom line for us is we believe we will maneuver the future well, just like we have for over 30 years. Your job, just like ours today, is more difficult because these observations are difficult to answer. Let us help in any way you would find useful.

Disclosure

Greenrock Research is a registered investment advisor.

The information provided herein is intended for financial professionals and represents the opinions of Greenrock Research management, and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance is not necessarily indicative of future returns and the value of investments and the income derived from them can go down as well as up.

Our views expressed herein are subject to change and should not be construed as a recommendation or offer to buy or sell any security or invest in any sector and are not designed or intended as basis or determination for making any investment decision for any security or sector.

There is no guarantee that the objectives stated herein will be achieved.

All factual information contained herein is derived from sources which Greenrock believes are reliable, but Greenrock cannot guarantee complete accuracy.

Any charts, graphics or formulas contained in this piece are only for the purpose of illustration.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited.

Share this

- January 2026 (1)

- October 2025 (1)

- July 2025 (1)

- April 2025 (1)

- January 2025 (1)

- October 2024 (1)

- July 2024 (1)

- April 2024 (1)

- January 2024 (1)

- October 2023 (1)

- August 2023 (1)

- March 2023 (2)

- December 2022 (1)

- September 2022 (1)

- June 2022 (1)

- March 2022 (1)

- December 2021 (1)

- September 2021 (1)

- June 2021 (1)

- March 2021 (1)

- December 2020 (1)

- September 2020 (1)

- June 2020 (1)

- March 2020 (1)

- December 2019 (1)

- September 2019 (1)

- June 2019 (1)

- March 2019 (1)

- December 2018 (1)

- September 2018 (1)

- June 2018 (1)

- March 2018 (1)

- December 2017 (1)

- September 2017 (1)

- June 2017 (1)

- March 2017 (1)

.png?width=2167&height=417&name=Greenrock-Logo%20(1).png)